From today's JB report found in the Midas' commentary at http://www.lemetropolecafe.com/:

Reuters has a colorful story datelined Singapore today:

"The market is very hot. There's plenty of physical demand and I can't meet the orders. It's from India, Indonesia and Thailand," said a physical dealer in Singapore. "Basically we are seeing buying from jewellers and investors from the Far East."

Friday, July 30, 2010

It's A Lazy (Almost) August Friday...

No motivation for a new post. You should listen to this intereview with the inestimably esteemed John Williams of http://www.shadowstats.com/: Why We Are F#cked

To kick-off the weekend on a proper note, I thought I would share this video of Widespread Panic playing with Dottie Peoples and The People's Choice Choir at the 1st annual Bonnaroo Festival in Manchester, Tennessee. I'll never forget standing there watching this huge southern soul choir file on stage to perform with Panic - it was easily one of the coolest live concert events I've ever witnessed...(Steve Winwood came out in the 2nd set and played piano on two Traffic songs with the band).

Naked in the mud, girl

Let's sling a little mud, girl

Just looking for a place to shed our skins

We're gonna summon the Holy Ghost from the battlefield

And in the morning this old world won't be the same

To kick-off the weekend on a proper note, I thought I would share this video of Widespread Panic playing with Dottie Peoples and The People's Choice Choir at the 1st annual Bonnaroo Festival in Manchester, Tennessee. I'll never forget standing there watching this huge southern soul choir file on stage to perform with Panic - it was easily one of the coolest live concert events I've ever witnessed...(Steve Winwood came out in the 2nd set and played piano on two Traffic songs with the band).

Naked in the mud, girl

Let's sling a little mud, girl

Just looking for a place to shed our skins

We're gonna summon the Holy Ghost from the battlefield

And in the morning this old world won't be the same

Thursday, July 29, 2010

Just Facts Today, Please

Fact Number One: Obama, will go down as the biggest lying snake-oil salesman to assume the throne in the Oval Office in my lifetime. Specifically, one of his PRIMARY campaign platforms was to make Government more transparent. So what do we have with the Farcical Retardation Bill (Financial Reform Bill)? Obama going on The View to sing praises of his accomplishments and pat himself grandly on the back.

But let's examine this closely: The SEC now has stated that this new "reform" legislation exempts the SEC from the Freedom Of Information Act:

Thanks Barak Hussein. Who's side are you on? I could pontificate for hours on just how damaging and useless this new legislation is, but you can do your own due diligence. Anyone who continues to support Obama either refuses to examine the facts or is just simply a complete idiot. As the ultimate poster child for Affirmative Action, Obama sure has proven to be extraordinarily deceitful and useless.

Fact Number Two: The real estate market is in much worse shape than anyone in the industry or at the banks will admit. Check out this gem from today's Denver Post: "Nine condominiums atop the Ritz-Carlton, Denver will be sold at auction next month with minimum bids starting at less than half of their original listing prices...Only one of the project's 25 units sold before the remaining condos were foreclosed on in November. Here's the link to the article: Real Estate = Look Out Below.

This factoid ties into my blog post from a couple days ago in which I stated that banks were fraudulently pricing way too high their real estate assets stagnating on their balance sheets. Only one unit out of 25 was sold, nine are being auctioned with the starting price less than 50% of the original offering price. Make no mistake, the clearing prices, if these units move at all, will be well below the opening offer. And that will leave 15 more foreclosed units still to go. Wouldn't we all like to see where the lending bank has the mortgage paper on these properties priced? Obama's new legislation will make it impossible to ever know.

There seems to be this myth that prices in the housing industry are stabilizing - a myth being propped up by the deceptive Case-Shiller 20 city housing price index. This index is very limited in scope and it skews the data by only looking at "organic" conventional seller to conventional buyer transactions. With foreclosures and short-sales making up roughly 50% of the total sales over the last 12 months, the C-S index is clearly overestimating the true price level of the market by ignoring half of the datapoints.

In fact, foreclosures rose in the first half of 2010 in 75% of 206 U.S. metro areas: Foreclosure avalanche. This ultimately will further depress home values. Unless the Government decides to start bulldozing entire communities, supply is rising much more rapidly than demand.

Moreover, 30-yr mortgage rates just hit a record low today, and yet the housing market is still in a downward spiral. This underscores the point that the Fed is pretty much out of non-printing press "tools" with which to reinflate the economy.

For the record, Obama is the first President ever to go on daytime "chat" television. To be quite frank, I believe his appearance on The View completely and utterly degrades the Office of the Presidency, is nothing more than a cheap campaign tactic aimed at garnering support from all of the desperate, pathetic housewives overdosed on Prozac who have no meaning in their life other than hanging onto every piece of garbage emitted from the mouths of Whoopi Goldberg and Barbara Walters, the latter of whom happens to be semi-comatose at this point in her life. It's beyond disgusting. "Mighty fine day indeed to you too, Miss Daisy."

But let's examine this closely: The SEC now has stated that this new "reform" legislation exempts the SEC from the Freedom Of Information Act:

The law, signed last week by President Obama, exempts the SEC from disclosing records or information derived from “surveillance, risk assessments, or other regulatory and oversight activities.” Given that the SEC is a regulatory body, the provision covers almost every action by the agency, lawyers say. Congress and federal agencies can request information, but the public cannot...The SEC cited the new law Tuesday in a FOIA action brought by FOX Business Network.That's some kind of reform! Here's a link to the article I sourced, but this is all over the internet: Obama = Less Transparency I guess the SEC is trying to protect its most favorite and coveted porn-surfing sites.

Thanks Barak Hussein. Who's side are you on? I could pontificate for hours on just how damaging and useless this new legislation is, but you can do your own due diligence. Anyone who continues to support Obama either refuses to examine the facts or is just simply a complete idiot. As the ultimate poster child for Affirmative Action, Obama sure has proven to be extraordinarily deceitful and useless.

Fact Number Two: The real estate market is in much worse shape than anyone in the industry or at the banks will admit. Check out this gem from today's Denver Post: "Nine condominiums atop the Ritz-Carlton, Denver will be sold at auction next month with minimum bids starting at less than half of their original listing prices...Only one of the project's 25 units sold before the remaining condos were foreclosed on in November. Here's the link to the article: Real Estate = Look Out Below.

This factoid ties into my blog post from a couple days ago in which I stated that banks were fraudulently pricing way too high their real estate assets stagnating on their balance sheets. Only one unit out of 25 was sold, nine are being auctioned with the starting price less than 50% of the original offering price. Make no mistake, the clearing prices, if these units move at all, will be well below the opening offer. And that will leave 15 more foreclosed units still to go. Wouldn't we all like to see where the lending bank has the mortgage paper on these properties priced? Obama's new legislation will make it impossible to ever know.

There seems to be this myth that prices in the housing industry are stabilizing - a myth being propped up by the deceptive Case-Shiller 20 city housing price index. This index is very limited in scope and it skews the data by only looking at "organic" conventional seller to conventional buyer transactions. With foreclosures and short-sales making up roughly 50% of the total sales over the last 12 months, the C-S index is clearly overestimating the true price level of the market by ignoring half of the datapoints.

In fact, foreclosures rose in the first half of 2010 in 75% of 206 U.S. metro areas: Foreclosure avalanche. This ultimately will further depress home values. Unless the Government decides to start bulldozing entire communities, supply is rising much more rapidly than demand.

Moreover, 30-yr mortgage rates just hit a record low today, and yet the housing market is still in a downward spiral. This underscores the point that the Fed is pretty much out of non-printing press "tools" with which to reinflate the economy.

For the record, Obama is the first President ever to go on daytime "chat" television. To be quite frank, I believe his appearance on The View completely and utterly degrades the Office of the Presidency, is nothing more than a cheap campaign tactic aimed at garnering support from all of the desperate, pathetic housewives overdosed on Prozac who have no meaning in their life other than hanging onto every piece of garbage emitted from the mouths of Whoopi Goldberg and Barbara Walters, the latter of whom happens to be semi-comatose at this point in her life. It's beyond disgusting. "Mighty fine day indeed to you too, Miss Daisy."

Wednesday, July 28, 2010

Bank Mortgage Fraud Redux

Yesterday in my blog post I asserted that banks are fraudulently dragging out the foreclosure process on homes, including delaying the accounting declaration of delinquencies. This serves two purposes: 1) It allows the banks to release previous loss reserves into their income statements by lowering their loss reserves and recognizing the "release" of these reserves as income, thereby boosting earnings. This is a pure paper/phantom GAAP accounting manipulation that will ultimately hammer most banks down the road. Please refer to the management commentaries that accompany the big bank earnings releases from last week if don't believe me. And 2) By understating delinquencies and foreclosures, it makes the balance sheet look stronger from a credit risk standpoint and it reduces reserve requirements for these banks. This is another component of the moral hazard and fraud that has completely infected our financial system and has been gloriously enabled by the idiot in the Oval Office and his band of merry thiefs running the White House.

And if you think I'm exaggerating, please read through this letter from a mortage professional sent into Reggie Middleton, who's http://www.boombustblog.com/ is one of the definitive truth-in-disclosure forensic accounting blogs out there:

Hello Reggie,

And if you think I'm exaggerating, please read through this letter from a mortage professional sent into Reggie Middleton, who's http://www.boombustblog.com/ is one of the definitive truth-in-disclosure forensic accounting blogs out there:

Hello Reggie,

I’m a big fan of your blog and greatly appreciate your diligent efforts in effectively educating your readers while exposing the the biggest heist ever perpetrated on the American Public by Wall Street. I know you are the most up to date person out there when it comes to the scams the banks are running but I wasn’t sure if you knew of a specific scam that they have been running on the mortgage side of their business. I’m hoping you can be the voice that warns people of a new type of fraud which the banks are perpetrating in broad day light.

I have been a Mortgage Banker for the last 18 years. I also follow the markets and particularly the banking sector with great interest. While reviewing the Banks most recent quarterly earnings, the common theme evident in all of their disclosures was that their delinquency rates had dropped dramatically and hence they were lowering their loan loss reserves.

Meanwhile, I have repeatedly come across delinquent and even defaulted loans which are not being properly reported by the loan servicers to the credit bureaus.

As an example, I recently came across a new mortgage client who was referred to me and I thought I’d share it with you for a potential story. These particular clients had a house which they were way upside down on, so last year they went ahead and purchased another house under an FHA loan with 3.5% down and immediately let the old, upside down house go into foreclosure thereafter.

These particular clients called me to see if they could refinance their new home’s FHA loan to a lower rate. I told them that it would be near impossible because of the damage done to their credit by the foreclosure on the previous house. They were adamant that their scores were still in the high 670’s and so I ran both of their credit reports. Sure enough, his middle score was a 674 and her score was a 678. When I looked at the previous mortgage, it showed as “FORECLOSED- NO DELINQUENCIES”!!! When I asked them they stated that they hadn’t made a payment to the bank for more than a year prior to the foreclosure on their house.

Same is true for many loan modification cases that I have come across. While the banks are dragging out the process with the borrowers, who are living in the homes 100% mortgage free, their statements reflect the borrowers as being current every month.

Is that not just absolutely ridiculous!?!? This is blatant fraud!

While Bank CEO/CFOs are going on their quarterly calls and lying to investors about how they are reducing their loan loss reserves due to their delinquency rates being substantially lower, they are deliberately falsifying their credit ratings while foreclosing on homeowners.

What happens when these banks end up losing billions of dollars on all of these foreclosures after depleting their loan loss reserves? More of 2008 is what I imagine. Except their won’t be any more bailouts.

I implore you to please feel free to contact me or any other sources you may have at your disposal to investigate this newest fraud being perpetrated against investors. Should you be interested, I can forward you the above credit report for your review.

Investors should know what the heck is going on before they listen to analysts telling them that “this is a buying opportunity of a lifetime” while the banks are fudging their numbers. This is exactly how we got into this mess. Investment Banks pulling Repo 105 scams, not marking their books correctly, and so on.

Shame on them for defrauding investors and the Public the first time and causing the global credit crisis. Shame on us for sitting by and letting it happen again two years later while they wipe out millions more of investors retirement accounts and cause the next Great Depression.

Tuesday, July 27, 2010

House Price Bowel Movements - A Two-Part Opus (Supply/Demand)

I was chatting with a couple last night who is contemplating moving to Denver and was looking to buy an apartment. I suggested that they should rent rather than buy, because prices are going lower. They looked puzzled and asserted that they thought we were at a bottom. This motivated me to put together an analysis which should explain in no uncertain terms why housing has a lot farther to fall in price.

I think most people still buy into the argument that housing goes up in value over the long run and that price declines are to be bought. That fact of the matter is that if you look at housing prices since 1891, prices have gone up nominally around 3% per annum, or roughly in line with inflation. Net-net in real terms, housing has not increased in value (you can use google to source the data).

The current housing bubble and subsequent "pop" can be traced back to roughly 1991 and occurred in two-stages. The first stage of the housing bubble was fueled by the Fed taking interest rates from historic highs back in 1980 to historic lows still being plumbed today. When I started as a junk bond trader back in 1991, the yield on the 10-yr bond was around 8%. Today it is flirting with going below 4%. The Fed was able to engineer an increase in real estate by significantly lowering the cost of financing a home.

The second stage of the housing bubble, and the one which proved to be housing's demise, was the Fed and the Government in tandem proliferating the widespread expansion and use of credit. By 2005, there was so much fraud and abuse in the mortgage system, that there's actually accounts in which people were using their dog's name to get a mortgage and buy investment homes and criminals buying a portfolio of investment homes from prison cells (true stories). The Fed used this fraudulent increase in housing values to fuel all kinds of consumption-based economic expansion and the result was complete destabilization of the financial system, culminating with the de facto collapse of the banking system in September 2008.

So what now? The Fed is out of the gun powder it used to inflate the housing market from 1991 - 2007. Short term interest rates are essentially negative (on an inflation-adjusted basis) so rates can not go any lower, mortgage rates hit new record lows almost on a daily basis and still fail to stimulate new buying, and the reckless, fraudulent use of credit has been severely curtailed, though not eliminated entirely. If you take away these two factors, what dynamic can possibly keep housing prices from falling futher?

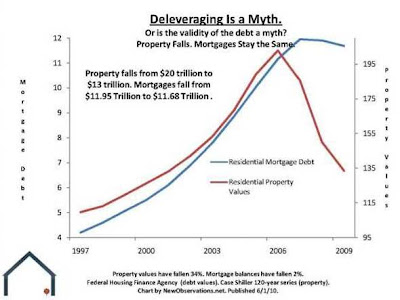

The myth out there is that the consumer is deleveraging. Does this look like that's a fact?:

Once you remove the two extremely artificial, unsustainable stimulative tools of lower interest rates and unlimited credit, the two real economic components which drive price are supply and demand. Let's examine those.

Demand. Now that the taxpayer subsidy of home buying as expired, the demand for housing has literally dropped off of a cliff. Contracts on new homes hit an all-time low in May and hit an all-time low for June as reported yesterday (this data goes back to 1963, so you can see how extreme these numbers are). Existing home sales are also hitting record lows. What can possibly stimulate demand? The job market continues to contract, unless you include the public workers who are standing around watching other workers dig up our roads, clog traffic and build sidewalks to nowhere. But they already likely own homes or do not have the credit scores rquired to finance a home. So I don't see rising income and employment as a contributing factor. Anyone else have any ideas?

Supply. Although I don't know why, new homebuilders continue to build new homes. Of course, the last thing this market needs is a new sources of supply. The existing home base is in the process of being puked back onto the market in the form of "strategic" defaults - otherwise known as "jingle mail" - in which the underwater homeowner turns his keys into the bank; rapidly rising levels of bank and GSE-repossessed homes (REO inventory); rapidly rising levels of delinquent and in-default homeowners; growing numbers of "shadow" sellers who would like to sell their home but see the equivalent home across the street on the market for a lower price than the would-be seller is hoping to get.

Here's some proof:

14% Of Mortgages In Foreclosure OR Delinquent

Strategic Defaults Rising

Jumbo Mortgage Delinquencies 50% Higher Than Average

S&P Expects 70% Re-default Rate On Modified Mortgages

Foreclosure Supply Grows Pushing Prices Lower

More On Supply. Here's a chart that I find really interesting. The source is cited on the chart:

I think most people still buy into the argument that housing goes up in value over the long run and that price declines are to be bought. That fact of the matter is that if you look at housing prices since 1891, prices have gone up nominally around 3% per annum, or roughly in line with inflation. Net-net in real terms, housing has not increased in value (you can use google to source the data).

The current housing bubble and subsequent "pop" can be traced back to roughly 1991 and occurred in two-stages. The first stage of the housing bubble was fueled by the Fed taking interest rates from historic highs back in 1980 to historic lows still being plumbed today. When I started as a junk bond trader back in 1991, the yield on the 10-yr bond was around 8%. Today it is flirting with going below 4%. The Fed was able to engineer an increase in real estate by significantly lowering the cost of financing a home.

The second stage of the housing bubble, and the one which proved to be housing's demise, was the Fed and the Government in tandem proliferating the widespread expansion and use of credit. By 2005, there was so much fraud and abuse in the mortgage system, that there's actually accounts in which people were using their dog's name to get a mortgage and buy investment homes and criminals buying a portfolio of investment homes from prison cells (true stories). The Fed used this fraudulent increase in housing values to fuel all kinds of consumption-based economic expansion and the result was complete destabilization of the financial system, culminating with the de facto collapse of the banking system in September 2008.

So what now? The Fed is out of the gun powder it used to inflate the housing market from 1991 - 2007. Short term interest rates are essentially negative (on an inflation-adjusted basis) so rates can not go any lower, mortgage rates hit new record lows almost on a daily basis and still fail to stimulate new buying, and the reckless, fraudulent use of credit has been severely curtailed, though not eliminated entirely. If you take away these two factors, what dynamic can possibly keep housing prices from falling futher?

The myth out there is that the consumer is deleveraging. Does this look like that's a fact?:

(click on chart to enlarge)

The fact of the matter is that the only segment of our system that has somewhat deleveraged (off-balance-sheet derivatives notwithstanding) is the financial sector. But that debt was transferred to the public sector via Tim Geithner Treasury guarantees and outright Treasury monetization (thanks Tim, Barak!). If you add that into the blue line above, the consumers debt burden has actually increased. Those are irrefutable facts. I don't care what kind of garbage CNBC or the Wall Street Journal or Barron's or Obama want to propagate. They are lying.

Once you remove the two extremely artificial, unsustainable stimulative tools of lower interest rates and unlimited credit, the two real economic components which drive price are supply and demand. Let's examine those.

Demand. Now that the taxpayer subsidy of home buying as expired, the demand for housing has literally dropped off of a cliff. Contracts on new homes hit an all-time low in May and hit an all-time low for June as reported yesterday (this data goes back to 1963, so you can see how extreme these numbers are). Existing home sales are also hitting record lows. What can possibly stimulate demand? The job market continues to contract, unless you include the public workers who are standing around watching other workers dig up our roads, clog traffic and build sidewalks to nowhere. But they already likely own homes or do not have the credit scores rquired to finance a home. So I don't see rising income and employment as a contributing factor. Anyone else have any ideas?

Supply. Although I don't know why, new homebuilders continue to build new homes. Of course, the last thing this market needs is a new sources of supply. The existing home base is in the process of being puked back onto the market in the form of "strategic" defaults - otherwise known as "jingle mail" - in which the underwater homeowner turns his keys into the bank; rapidly rising levels of bank and GSE-repossessed homes (REO inventory); rapidly rising levels of delinquent and in-default homeowners; growing numbers of "shadow" sellers who would like to sell their home but see the equivalent home across the street on the market for a lower price than the would-be seller is hoping to get.

Here's some proof:

14% Of Mortgages In Foreclosure OR Delinquent

Strategic Defaults Rising

Jumbo Mortgage Delinquencies 50% Higher Than Average

S&P Expects 70% Re-default Rate On Modified Mortgages

Foreclosure Supply Grows Pushing Prices Lower

More On Supply. Here's a chart that I find really interesting. The source is cited on the chart:

(click on chart to enlarge)

What these two graphs show is that 1) it is taking longer every month for banks to unload their foreclosed housing inventory - and we know this inventory is growing by the month and 2) there's a growing inventory of homes that are sitting delinquent for more than 2 years. You want to live rent free? Go buy a home and then default on the mortgage. According to chart on the right, you might be able to go at least 24 months without making a payment before the bank kicks you out.

And here's the most horrifying chart of all. Anyone who looks at this chart, understands it and still buys a home either doesn't care about money or is insane:

(click on chart to enlarge)

Let me explain this chart. This chart shows the number of existing homes reported to be on the market for sale PLUS the number of homes that have delinquent mortgages. The literal interpretation of this chart is that if every deliquent mortgage defaults and goes into foreclosure, the total potential housing inventory is close to 12 million homes. The average monthly sales annualized of existing homes going back to 1999 is 479,000. In the worst case, assuming all of the delinquent mortgages default, the existing home inventory is over 25 months. Typical inventory historically is 5 months. You can play "what if" with 7.7 million delinquent mortgages to skew the result, but that works both ways. If only 50% of the delinquencies foreclose, that number months inventory goes down to 16 months. Still 300% higher than normal. BUT, banks are known to be dragging their feet in declaring homes to be delinquent or in default (in order to avoid more capital reserve requirments), which obviously implies the 7.7 million number is likely too low. Any way you want "manipulate" the numbers, the end result is that there is a supply avalanche of existing homes on the market and soon to be on the market.

So there we have it. Demand for homes is rapidly declining and the supply is rapidly increasing. Now, I know that Alan Greenspan and Ben Bernanke and Larry Summers believe that they have the magic formula for changing the universal law of supply and demand (what Ivy League douche-bag doesn't think of themselves as being above the laws of nature?). But that realistically not being the case, there is only one way for the market to resolve the supply/demand problem as described above and that's with substantially lower prices. Sorry but those are the facts of life and the underlying natural laws of the universe.

John Templeton, considered one of the founding fathers of the the mutual fund industry and one of the most respected investors in our era, said back in the early part of the decade from his retirement home in the Bahamas that he would not consider investing in U.S. real estate in any capacity until the price level had dropped 90% from peak valuations. At the time that was more extreme than my view that prices would fall at least 75% from top to bottom. But looking at the facts, I would not bet against Sir John's proclamation. I don't know if the ultimate price decline will be 75% or 90%, but I do know for certain that as long as there are people out there like the ones I was with last night who believe that prices have bottomed, the housing market still has a long way to fall before the ultimate bottom is reached.

Monday, July 26, 2010

Some Monday Observations...

New Home Sales - The media ushered in the Commerce Department's new home sales for June with unusual ebullience and positive spin. Seasonally adjusted new home sales, as reported, came in a little better than Wall Street was forecasting at 330,000 (please note: seasonally adjusted - no one outside of the Govt's Ministry of Truth really knows what this means). The "spin" was evident in the headlined "23.6% sales increase" from May. What wasn't spelled out is that May's record low new home sales number was revised down even more from the originally reported - seasonally adjusted - 300,000 to 267,000. The 300,000 reported for May is the lowest new home sales number ever reported going back to 1963. That should put the 267,000 in perspective. However, arithmetically, that downward revision lets the media/CNBC jump all over the "23.6% increase" from May to June. See how this game works? The seasonally adjusted, annualized number for June was 16.7% below the sales rate for June 2009 AND it was the worst June on record. In terms of the inventory being reported as declining, don't put any stock in that number. The way the Census Bureau accounts for new home sales and cancellations - it's been running around a 20% cancellation rate industry-wide for about 3 years now - cancelled homes are not added back into the new homes inventory. So the real inventory of new homes has been significantly understated for at least 3 years. Given that the Government is the entity that accounts for the new home sales market, this should not surprise anyone.

QE2 Anyone? You may be looking at it right here:

QE2 Anyone? You may be looking at it right here:

Everyone I'm sure knows this graph by now. "Excess Reserves" are the funds banks keep on deposit at the Fed which are "in excess" of mandatory reserve requirements. When you look at this number, understand that it comes from all of the worthless assets the Fed purchased from the banks. This graph above is EXACTLY why we did not have a completely collapsed banking system in September 2008. Also understand that Tim Geithner willingly slapped a Taxpayer guarantee on the value of the assets that the Fed bought from the banks to produce that graph above. In other words, WHEN - not IF - those assets collapse in value, YOU will be asked to reimburse the Fed. You like apples, how about THOSE apples?

Anyway, the Fed is currently paying interest on those excess reserves you see above. This was partially done to keep that money out of the general banking system, theoretically preventing the unleashing of inflationary forces into the system. But alas, the money has already been printed, it's backed by worthless assets, the underlying devaluation of the U.S. dollar has already occurred. Where is this leading? The Fed has telegraphed last week that it intends to stop paying interest on the excess reserves in order to stimulate bank lending by disincentivizing the banks from keeping those funds at the Fed. But to whom will the banks be lending? Home builders? Car manufactures? Blockbuster Video (going bankrupt)? Anyone out there starting up a new landscaping business? How about new golf courses - do we need anymore of those? See what I'm saying? If the Fed stops paying interest on the excess reserves, expect to see that money being funnelled into more Treasury auctions and into the stock market. You see? The Fed can start to unleash QE2 without even making a formal announcement, because it's already been created, just not put to work - yet.

I just realized I need to clarify one point. That graph above is the by-product of QE1. If the assets purchased by the Fed to create those excess reserves were worth 100% on the dollar, the Fed could reverse QE1 by selling those assets back to the banks now that they are supposedly solvent and thereby draining the excess reserves from the system. However, most of those assets are completely worthless. Bernanke knows it and I know it. BUT, recall that the Treasury is guaranteeing those assets. When the time comes to "monetize" them, the money will have to be printed up and the obligation will be transferred from the Fed to the Treasury. BUT, the excess reserves held at the Fed will, by that time, already have flowed into the system - either in Treasury auction support, the stock market or more morally hazardous lending which is also guaranteed by Geithner's Treasury. In this manner, the Fed has already - de facto - somewhat unleashed QE2, as the roots of QE2 are seeded in QE1. Hope this makes sense. If not, this will:

Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked, ‘Account overdrawn.’ (Atlas Shrugged)

Friday, July 23, 2010

The White House Celebrates The Extenstion Of Unemployment Welfare...

I love you Mary Jane...

This author is wondering if maybe The El Hefe was going to dabble a little before he gets on t.v. today to tell what a great job he's doing the economy...

This author is wondering if maybe The El Hefe was going to dabble a little before he gets on t.v. today to tell what a great job he's doing the economy...

Thursday, July 22, 2010

BOOM Goes The Dynamite

"I know that you don't need this gold at present. What you need is the justice which it represents, and the knowledge that there are men who care for justice" (Atlas Shrugged).

Which chart do you want to own? (click on each to enlarge)

Which chart do you want to own? (click on each to enlarge)

As an aside: one of the most pathetic human beings I have ever observed, outside of Ben Bernanke, is Barney Frank.

Wednesday, July 21, 2010

I Had To Post This Comment...

A regular reader/commentor, had this to say about the Farcical Retardation Act (Financial Reform Act) signed into law by that empty suit in the Oval Office:

This just in on BP:

BP caught putting a photoshopped photograph on its website which enhanced the illusion of activity at its spill center. Here's the article: BP = Fraud. At this point, anyone who believes anything BP has to say about this catastrophe is a complete moron - et tu Barak?

Matt Simmons' latest interview courtesy of another commentor - this is MUST-watch: BP/Obama Lie

I find it funny that if you take the Dodd-Frank bill, change it to Frank-Dodd Bill, shortened it to Fr-Odd it sounds more like what it is...Just an afternoon observation from the SofaI just couldn't let that comment gather cobwebs in the comment section...

This just in on BP:

BP caught putting a photoshopped photograph on its website which enhanced the illusion of activity at its spill center. Here's the article: BP = Fraud. At this point, anyone who believes anything BP has to say about this catastrophe is a complete moron - et tu Barak?

Matt Simmons' latest interview courtesy of another commentor - this is MUST-watch: BP/Obama Lie

Comex Silver Intrigue Builds

Surprisingly, the open interest on the Comex for both gold and silver declined again yesterday. This is unusual for a day in which the price of gold and silver rise like they did yesterday. Once again it calls into question the Comex's reporting credibilty. There remains 719 open silver contracts - representing nearly 3.6 million ounces of silver. This is also an unusually high amount of open contracts this late into a delivery period. In fact, if you are a large holder of SLV who aspires to one day redeem your shares for silver, and given that JPM is the custodian and the absurd short in Comex silver, I would be very afraid to look in that cupboard for fear it might be bare.

In order to dispel any confusion over key expiration dates for the balance of July, as they apply to gold and silver trading, here is the Comex schedule: Options expiry for August contracts is July 27; Last trade day for July contracts is July 28; Last notice day for delivery is July 29; Last delivery day is July 30; First notice for August contracts is July 30 (anyone not funded for delivery must be out). All of this information can be found LINK.

Just for the record, I fully expect that this bulge of open silver contracts waiting for delivery will come and go with very little drama - at least for public inspection. Having said that, we have been on the waiting end of Comex silver several times, two of which HSBC was the delivering counterparty AND we did not receive our silver until well after the contractually specified last delivery day. In fact, last year we received our April silver on June 20th. I have also received reader emails detailing similar delays in receiving Comex silver. What this points to is extreme stress in Comex silver inventories and one of these months - although as noted I don't believe this month - the problems behind the scenes will become apparent to all.

...my single state of man that function

Is smother'd in surmise, and nothing is

But what is not. (Macbeth, Act 1, Scene 3)

In order to dispel any confusion over key expiration dates for the balance of July, as they apply to gold and silver trading, here is the Comex schedule: Options expiry for August contracts is July 27; Last trade day for July contracts is July 28; Last notice day for delivery is July 29; Last delivery day is July 30; First notice for August contracts is July 30 (anyone not funded for delivery must be out). All of this information can be found LINK.

Just for the record, I fully expect that this bulge of open silver contracts waiting for delivery will come and go with very little drama - at least for public inspection. Having said that, we have been on the waiting end of Comex silver several times, two of which HSBC was the delivering counterparty AND we did not receive our silver until well after the contractually specified last delivery day. In fact, last year we received our April silver on June 20th. I have also received reader emails detailing similar delays in receiving Comex silver. What this points to is extreme stress in Comex silver inventories and one of these months - although as noted I don't believe this month - the problems behind the scenes will become apparent to all.

...my single state of man that function

Is smother'd in surmise, and nothing is

But what is not. (Macbeth, Act 1, Scene 3)

Tuesday, July 20, 2010

Gartman Remains Perfect As A Contrarian Indicator In Gold; Problems On The Comex?

Dennis Gartman was on CNBC yesterday explaining with his unique brand of arrogant stupidity that the trend in gold has changed (to down). Contrary to DG's ignorance, I've been telling colleagues that the current period of time is strikingly similar to the period from July/Aug 2005 to May 2006, when gold staged a 35% move and silver nearly tripled. I vividly recall, literally about 2 or 3 days before gold started a massive move from $550, Gartman grandly pontificated for all to hear that he was out of gold and would reload below $500. He never had that opportunity. He missed the entire move. Remember: those who can, do - those who can't, sell newsletters.

Dennis does not follow or understand the physical market. He's too blinded by his own self-proclaimed market expertise. The fact is that he has his head up his ass when it comes to the precious metals market.

The key to the precious metals Kingdom at this stage of the game is to follow and understand what is happening in the physical market. Pay no attention to reports of IMF selling, BIS wife-swapping and Wall Street misdirection. The fact of the matter is that Asia, Russia, India, Turkey and the Middle East are buying up as much physical gold and silver as they can and the Western Central Banks are running out of gold to sell.

Here is the information you need to know about the physical market, which is contained in the "JB" gold market report posted every night a www.lemetropolecafe.com in the Midas report on the James Joyce Table (I honestly do not know how anyone can invest/trade this market without reading Midas every night):

"Demand is extremely good from Indonesia and Thailand. There's also good buying from local buyers

See http://in.reuters.com/article/domesticNews/idINSGE66J0AD20100720

The bulliondesk.com reports:

Premiums for gold bars in Tokyo rose to 50 cents this week from 25 cents last week, according to one source. They had stood at 50 cents during the first week of July but had been in negative territory in the preceding months...

"[Gold] has started to see quite good demand overall from Asian sector, Far East and India," a Switzerland-based trader said. "At these levels there has been some good demand and activity there and this should lend some good support to the gold market."

"Even in the Middle East we are starting to see some more demand coming in... overall, we’re starting to see some more interest because the market is trying to consolidate," he added

In Europe, requests for kilobars have picked up...

As per JB's report, the import premium in Viet Nam has kicked up to $26 over spot gold. This means Viet Nam is buying aggressively. Same with Shanghai ($3.50 over world gold, a relatively high premium for that market). People, this means demand is running hot vs. supply in those markets.

In addition, the Russian Central Bank reports adding another 6 tonnes of gold during June. The ECB did not sell any gold once again last week AND, this is the first time I have seen this in a very long time, one bank actually added 1 million ounces in coin.

(Did Gartman happen to mention any of this on CNBC yesterday LOL).

As we are now seeing with delivery delays and massive silver withdrawals recently from the Comex, the paper game that has been played by the big bullion banks in London and New York is finally being understood for what it is by big U.S. investors (see Greenlight Capital's announcement a year ago that it dumped its large GLD position and replaced it with physical gold that is safekeeps privately).

If you don't pay attention to and understand the dynamics of the global physical market, you leave yourself exposed to the mercy of the financial media frauds and fabricators. If you need some "soul food," watch for Stewart Thomson's posts on http://www.321gold.com/. Here's his latest: LINK

"Destroyers seize gold and leave to its owners a counterfeit pile of paper. This paper is a mortgage on wealth that does not exist...by legal looters" (Atlas Shrugged)

Please don't let the Dennis Gartman's, JP Morgans and Goldman Sachs' of the world legally steal your gold/silver.

Dennis does not follow or understand the physical market. He's too blinded by his own self-proclaimed market expertise. The fact is that he has his head up his ass when it comes to the precious metals market.

The key to the precious metals Kingdom at this stage of the game is to follow and understand what is happening in the physical market. Pay no attention to reports of IMF selling, BIS wife-swapping and Wall Street misdirection. The fact of the matter is that Asia, Russia, India, Turkey and the Middle East are buying up as much physical gold and silver as they can and the Western Central Banks are running out of gold to sell.

Here is the information you need to know about the physical market, which is contained in the "JB" gold market report posted every night a www.lemetropolecafe.com in the Midas report on the James Joyce Table (I honestly do not know how anyone can invest/trade this market without reading Midas every night):

"Demand is extremely good from Indonesia and Thailand. There's also good buying from local buyers

See http://in.reuters.com/article/domesticNews/idINSGE66J0AD20100720

The bulliondesk.com reports:

Premiums for gold bars in Tokyo rose to 50 cents this week from 25 cents last week, according to one source. They had stood at 50 cents during the first week of July but had been in negative territory in the preceding months...

"[Gold] has started to see quite good demand overall from Asian sector, Far East and India," a Switzerland-based trader said. "At these levels there has been some good demand and activity there and this should lend some good support to the gold market."

"Even in the Middle East we are starting to see some more demand coming in... overall, we’re starting to see some more interest because the market is trying to consolidate," he added

In Europe, requests for kilobars have picked up...

As per JB's report, the import premium in Viet Nam has kicked up to $26 over spot gold. This means Viet Nam is buying aggressively. Same with Shanghai ($3.50 over world gold, a relatively high premium for that market). People, this means demand is running hot vs. supply in those markets.

In addition, the Russian Central Bank reports adding another 6 tonnes of gold during June. The ECB did not sell any gold once again last week AND, this is the first time I have seen this in a very long time, one bank actually added 1 million ounces in coin.

(Did Gartman happen to mention any of this on CNBC yesterday LOL).

As we are now seeing with delivery delays and massive silver withdrawals recently from the Comex, the paper game that has been played by the big bullion banks in London and New York is finally being understood for what it is by big U.S. investors (see Greenlight Capital's announcement a year ago that it dumped its large GLD position and replaced it with physical gold that is safekeeps privately).

If you don't pay attention to and understand the dynamics of the global physical market, you leave yourself exposed to the mercy of the financial media frauds and fabricators. If you need some "soul food," watch for Stewart Thomson's posts on http://www.321gold.com/. Here's his latest: LINK

"Destroyers seize gold and leave to its owners a counterfeit pile of paper. This paper is a mortgage on wealth that does not exist...by legal looters" (Atlas Shrugged)

Please don't let the Dennis Gartman's, JP Morgans and Goldman Sachs' of the world legally steal your gold/silver.

Monday, July 19, 2010

Intrigue Builds In The Comex Silver Pits

The July silver open interest increased by 31 contracts on Friday. Those people wouldn't be buying unless they intended to take delivery AND they couldn't buy unless their account was funded for the amount needed to take delivery. I don't scrutinize the o/i like this every month, but I have never noticed open interest increasing in a delivery month this close to to the end of the delivery cycle. Here's the open interest report for Friday: Comex Metals O/I

Why is this significant? Because right now there is over 3.5 million ounces of silver standing for delivery and silver has been leaving the "eligible" vaults (i.e. customer storage vaults) nearly every day this month. I really do not believe that the Comex has the ability to deliver that much silver without tapping into an outside source, like SLV. JPM, per Ted Butler's analysis of the COT and Bank Participation Report, is short close to 30% of the entire Comex silver open interest. Not coincidentally, JP Morgan also happens to be the custodian of SLV. If you don't believe that there is foul play going on, something is wrong with your brain.

Why is this significant? Because right now there is over 3.5 million ounces of silver standing for delivery and silver has been leaving the "eligible" vaults (i.e. customer storage vaults) nearly every day this month. I really do not believe that the Comex has the ability to deliver that much silver without tapping into an outside source, like SLV. JPM, per Ted Butler's analysis of the COT and Bank Participation Report, is short close to 30% of the entire Comex silver open interest. Not coincidentally, JP Morgan also happens to be the custodian of SLV. If you don't believe that there is foul play going on, something is wrong with your brain.

More Proof Matt Simmons Is Right

Just read this: Oil Leaking From Seabed. For the record, everything Matt Simmons said on various mainstream media news outlets is exactly the same information that was relayed to me a few weeks ago, and I believe the ulitmate source was NOAA. Matt Simmons specifically references NOAA in his MSNBC interview. But in the end, the market will be the final arbiter - see what the market thinks HERE

BP is going to zero, just like Enron, Refco, Countrywide, Wash Mutual, FNM, FRE, GM, et al...

BP is going to zero, just like Enron, Refco, Countrywide, Wash Mutual, FNM, FRE, GM, et al...

Sunday, July 18, 2010

More On Scotiabank's Fraudulent Bullion Safekeeping Services

If you read this story and decide to keep your bullion at Bank Nova Scotia - OR utilize investment products that are supposedly backed by gold/silver which are safekept at BNS - may your god have mercy on your net worth. For all others, please read this story, go back and review Harvy Organ's experience with Scotia and then go retrieve every ounce of bullion from Scotia that is rightfully your's. You should move it a private depository, like First State Depository in Delaware.

Here's the story link: Pulp Non-Fiction

Hat tip to the reader who posted the link in the comment section, which was originally posted HERE by GATA. If you have exposure to Scotia, I can only lead you to water...

Here's the story link: Pulp Non-Fiction

Hat tip to the reader who posted the link in the comment section, which was originally posted HERE by GATA. If you have exposure to Scotia, I can only lead you to water...

Sunday Quickie On Silver

A massive quantity of silver has been withdrawn from the Comex over the past month or so. On Thursday, the latest day for which data is made available, close to another million ounces was removed. Most of this silver is coming out of the "eligible" inventory. This is the inventory that belongs to private investors who are using the Comex as a depository. Some of these investors keep it there to make it convenient to re-sell on the Comex and some for convenience until they decide to take actual possession.

The total Comex silver inventory - at least the inventory which is being "reported" by the Comex - is down to 110 million ounces. I have seen the inventory this low, but it's been a long time. There is still about 3.5 million ounces worth of July silver contracts standing for delivery. This is an unusually large amount at this stage in the delivery cycle. There is no question in my mind that last week's massive paper manipulation of silver on the Comex was an attempt by JP Morgan, et al to try and shake loose a lot of those standing contracts. My bet is most the holders understand the drill and will take delivery anyway, because a year from now a $1 either way on the price of silver will be insignificant if silver does what a lot of us believe it will do.

Two questions come to mind: 1) Why are the Comex counterparties dragging their feet on delivering that 3.5 million ounces? 2) Why are an unusually large number of private investors removing their silver from Comex depositories? To be sure, in my mind these questions are strictly rhetorical. But I would suggest that anyone thinking about accumulating some silver for protection from what's coming should do so as soon as possible. To paraphrase Eric Sprott: One day you will wake up and decide to take delivery of your gold/(silver) only to find that it's not there to be delivered.

The total Comex silver inventory - at least the inventory which is being "reported" by the Comex - is down to 110 million ounces. I have seen the inventory this low, but it's been a long time. There is still about 3.5 million ounces worth of July silver contracts standing for delivery. This is an unusually large amount at this stage in the delivery cycle. There is no question in my mind that last week's massive paper manipulation of silver on the Comex was an attempt by JP Morgan, et al to try and shake loose a lot of those standing contracts. My bet is most the holders understand the drill and will take delivery anyway, because a year from now a $1 either way on the price of silver will be insignificant if silver does what a lot of us believe it will do.

Two questions come to mind: 1) Why are the Comex counterparties dragging their feet on delivering that 3.5 million ounces? 2) Why are an unusually large number of private investors removing their silver from Comex depositories? To be sure, in my mind these questions are strictly rhetorical. But I would suggest that anyone thinking about accumulating some silver for protection from what's coming should do so as soon as possible. To paraphrase Eric Sprott: One day you will wake up and decide to take delivery of your gold/(silver) only to find that it's not there to be delivered.

Saturday, July 17, 2010

Must-Listen Interview On King World News With Matt Simmons

Some key points:

- BP stock is worth zero

- the U.S. Govt should attach liens to all BP assets (this blog asserted that from the beginning)

- BP has lied about what's happening every step of the way from day 1 (remember when they said the spill was 1000 barrels per day?); "they conned everyone into believe that this was no big deal"

- Letting BP use the airwaves to promote and defend their company is like letting Iran be the Middle East peace spokesman

Here's the link: Worst Disaster Ever and Getting Worse - BP lying

Using the mainstream to look for the truth is like the drunk who looks for his lost wallet under the street light because that's where the light is shining...

- BP stock is worth zero

- the U.S. Govt should attach liens to all BP assets (this blog asserted that from the beginning)

- BP has lied about what's happening every step of the way from day 1 (remember when they said the spill was 1000 barrels per day?); "they conned everyone into believe that this was no big deal"

- Letting BP use the airwaves to promote and defend their company is like letting Iran be the Middle East peace spokesman

Here's the link: Worst Disaster Ever and Getting Worse - BP lying

Using the mainstream to look for the truth is like the drunk who looks for his lost wallet under the street light because that's where the light is shining...

Friday, July 16, 2010

Matt Simmons: The BP Cap Test Is "Absurd" And BP Is Lying To Us

Hard for anyone out there refute the industry knowledge of Matt Simmons. One colleague of mine, who was an oil and gas analyst at Salomon Brothers and who worked with Simmons for years, describes him as the definitive source for oil and gas industry expertise. Here's what Mr. Simmons has to say about the latest BP/Obama contrivance:

Thursday, July 15, 2010

Obama Pimps Out The Taxpayer As Goldman Urinates On The Law And Gets Away With It

The news hit 22 minutes after the stock market had closed, ironically on a day when the Senate passes the Financial Reform Bill (henceforth known on this blog as "The Farcical Retardation Bill"). The Obama Government settles a massive fraud case against Goldman, potentially worth billions in fines to the Taxpayer, for $550 million. Hmmm...let's see...if I commit fraud and break several laws and make several billion dollars in the process, I guess paying $550 million in fines ex post facto is just part of the cost of doing business in the land of Obama. Of course, CNBC was allowed to report the news first - News Link - and Goldman stock was up 4.6% in after hours trading.

Several years ago a colleague and I expressed to each other that the fraud and corruption in this country would eventually become so extreme and absurd that it would blow even our minds. This is one of those events. Setting aside pontificating about the horrifyingly benign deal that Obama gave Goldman, I would prefer to focus on Obama himself. Where is the slick speechmaker who promised to clean up DC and Wall Street and return Rule of Law to the people? To be quite frank, I believe at this point that ANYONE who fails to see how pathetically dishonest and incompetent Obama is as a President - of, by and for the People - is either a complete idiot or just refuses to look at the truth. I mentioned to another colleague today that I have not seen a President in my lifetime as completely useless as Obama. He makes W look a like a natural born leader - and this is coming from an observer - me - who started counting down the days until W was gone back in late 2000.

I believe this event can stand alone in underscoring the kind of cheap ghetto whore who now is sitting in the White House. A man who promised to deliver morality, ethics, virtue and trust back into the cradle of our system. Yet at every turn he takes our whole country deeper into the polluted swamp that belies the landfill upon which DC was built. This sums it up the best:

Several years ago a colleague and I expressed to each other that the fraud and corruption in this country would eventually become so extreme and absurd that it would blow even our minds. This is one of those events. Setting aside pontificating about the horrifyingly benign deal that Obama gave Goldman, I would prefer to focus on Obama himself. Where is the slick speechmaker who promised to clean up DC and Wall Street and return Rule of Law to the people? To be quite frank, I believe at this point that ANYONE who fails to see how pathetically dishonest and incompetent Obama is as a President - of, by and for the People - is either a complete idiot or just refuses to look at the truth. I mentioned to another colleague today that I have not seen a President in my lifetime as completely useless as Obama. He makes W look a like a natural born leader - and this is coming from an observer - me - who started counting down the days until W was gone back in late 2000.

I believe this event can stand alone in underscoring the kind of cheap ghetto whore who now is sitting in the White House. A man who promised to deliver morality, ethics, virtue and trust back into the cradle of our system. Yet at every turn he takes our whole country deeper into the polluted swamp that belies the landfill upon which DC was built. This sums it up the best:

In a moral society, these are the criminals, and the statutes are written to protect you against them. But when a society establishes criminals-by-right and looters-by-law - men who use force to seize the wealth of the disarmed citizens - then money becomes its creators' avenger...When you see that men get richer by graft and by pull than by work, and your laws don't protect you against them, but protect them against you - when you see corruption being rewared and honesty becoming a self-sacrifice - you may know your society is doomed (Atlas Shrugged).With this Goldman settlement, Obama has allowed "criminals-by-right and looters-by-law" and our society is doomed. Of course, we should have never assumed anything to the contrary once he appointed a serial tax-cheater to be the man in charge of collecting tax revenues...

Texas Teachers Retirement System Shrugs

The TTRS has invested $500 million in gold. Here's the article link: Gold Is Real Money; here's the mainstream media reaction: "it is rare for the investment managers to put large sums of money into a commodity whose value usually only grows through inflation."

And here's The Golden Truth:

And here's The Golden Truth:

Whenever destroyers appear among men, they start by destroying money, for money is men's protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper (think: FDR 1933). This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it (Atlas Shrugged).People who know, know the real reason TTRS is buying gold.

Has The Dollar Bear Emerged From A Brief Hibernation?

Back in May when the U.S. dollar index hit 84, I commented that it might be ready to rollover and go lower. I made the same call when it traded thru 86 in June. One particular reader was constantly busting my stones over this call. Well, here we are in mid-July, and the dollar - having topped out just above the 88 level, has crashed overnight below 83 as I write this. Here is the weekly chart of the U.S. dollar index, which if I may say so myself, looks pretty bearish:

For the sake of grace and humility, I will just say that anyone who shorted the dollar on my original call at 84 and held onto the position - minimally (without adding to the short at higher levels) - is now in a nice profit position. Furthermore, since gold has outperformed the dollar during this period, if you shorted the dollar at 84 and added to your gold position, you are happy x 2.

On a fundamental basis, if someone showed me the fiscal condition of every country in Europe, England, Japan and the U.S., without identifying the country with the balance sheet and budget statement, I would identify the U.S. as by far being in the most fundamentally hopeless condition.

To be sure, the dollar is a bit oversold technically and could bounce back up to the 84 level as those who shorted it at 88 take some profits. But using basic fundamental analysis on the economic, political and financial condition of the United States, I would be adding to my dollar short position on every bounce. You can look at the chart and assess where you would take some trading profits, but I believe that there is a very real probability that we could see the dollar ultimately go down and test that 72 "do or die" level sometime during the next 12 months.

BP update: I see there's no news on the renewed cap testing. Word to me is that the cap has failed, the sea-floor fracture at the wellhead is spreading and fish down by the Yucatan Peninsula in Mexico are being pulled out of the water with tar-balls in their belly. The oil dispersants being used by Haliburton are causing the oil to sink with the dispersant to the seafloor and the dispersant is heating up the massive methane hydrate pools which are accumulating on the seafloor from the leak. This has the potential to create an incredibly powerful greenhouse gas.

Wednesday, July 14, 2010

Random Musings On A Wed: The Economy Is Collapsing And BP Fails Again

ONCE again the Mortgage Bankers Association weekly purchase index took a nose-dive. The housing market is in a state of utter collapse. I see the visual proof all around as I drive around Denver. The purchase index dropped 3.1% from the previous week and now stands at its lowest level since 1996. On and unadjusted basis (unadjusted = not statistically manipulated), the purchase index was down 12.7% and 43% from the same week a year ago. Here's the news link: Visual: Wiley Coyote Dropping Off The Cliff

You can draw your own conclusions, but when I see purchase indicators reverting back to 1996 levels, it makes me believe that price levels will follow (think Economics 101 if you had it at a good school). What this means? Think back to what your home (or its equivalent) would have been worth in 1996. That's my next price level target. I have maintained since 2002 that housing prices would revert back to at least 1991 levels (start of the housing bubble). People thought I was nuts back then to make that call - now they fear I may be right (I fear I may be right) More will be revealed as this unfolds...

Are comatose, reality-tv brain-deadened Americas waking up?

I was surprised to wake this morning to discover that 70% of Americans do NOT believe the lies spewing forth from Bernanke and Obama about that economy and that more than 7 out of 10 Americans understand that the economy is tanking: the public is skeptical of the Obama administration’s stimulus program and wary of more spending, with more than half saying the deficit is “dangerously out of control.”

Here's the article link: Public Is Stirred Up It's too bad Obama never took any economics courses. But after all, this is the same man that 100% of you who comment on this blog would not put in charge of hot dog stand.

But wait, there's more. 80% of those polled believe that the Financial Reform Bill about to be passed and signed into legislation will be absolutely useless. A full 47% believe the legislation will to do more to protect the banks than consumers. Here's the link: More Harmful Obama Legislation Anyone paying attention to the farce going on in Congress over this legislation is well aware that the original purpose and drafting has been completely turned upside-down (please see the cartoon on the upper right of this blog). In fact, Ron Paul's legislation to audit the Fed has been almost completely removed.

Here is a razor's edge analysis of this Farcical Reform Bill by bulldog attorney and former SEC Chairman Harvey Pitt: All Bad, No Good That is well worth reading. If America truly wakes up, DC is going to have a problem. On the other hand, if you want to see how all this likely unfolds, go re-read Atlas Shrugged.

The BP/White House/Gulf Oil Spill Farce Continues

Not only has Obama put a cover on media access and truth proliferation about what is happening in the Gulf right now, but now BP/Obama are outright lying to us. For the last two days a BP official has been all over the financial media extolling the virtues and likely success of the latest capping effort. BP has been running horrifyingly bullshit-filled public relations ads (they should be spending that money helping all those whose lives have been ruined instead of propagating paid masturbation on tv for all to see). I knew that capping effort was failing when I watched BP stock stock plummet toward the end of the day yesterday.

And then I wake up to this:

So Obama continues to fiddle while the Empire is being looted and burned.

You can draw your own conclusions, but when I see purchase indicators reverting back to 1996 levels, it makes me believe that price levels will follow (think Economics 101 if you had it at a good school). What this means? Think back to what your home (or its equivalent) would have been worth in 1996. That's my next price level target. I have maintained since 2002 that housing prices would revert back to at least 1991 levels (start of the housing bubble). People thought I was nuts back then to make that call - now they fear I may be right (I fear I may be right) More will be revealed as this unfolds...

Are comatose, reality-tv brain-deadened Americas waking up?

I was surprised to wake this morning to discover that 70% of Americans do NOT believe the lies spewing forth from Bernanke and Obama about that economy and that more than 7 out of 10 Americans understand that the economy is tanking: the public is skeptical of the Obama administration’s stimulus program and wary of more spending, with more than half saying the deficit is “dangerously out of control.”

Here's the article link: Public Is Stirred Up It's too bad Obama never took any economics courses. But after all, this is the same man that 100% of you who comment on this blog would not put in charge of hot dog stand.

But wait, there's more. 80% of those polled believe that the Financial Reform Bill about to be passed and signed into legislation will be absolutely useless. A full 47% believe the legislation will to do more to protect the banks than consumers. Here's the link: More Harmful Obama Legislation Anyone paying attention to the farce going on in Congress over this legislation is well aware that the original purpose and drafting has been completely turned upside-down (please see the cartoon on the upper right of this blog). In fact, Ron Paul's legislation to audit the Fed has been almost completely removed.

Here is a razor's edge analysis of this Farcical Reform Bill by bulldog attorney and former SEC Chairman Harvey Pitt: All Bad, No Good That is well worth reading. If America truly wakes up, DC is going to have a problem. On the other hand, if you want to see how all this likely unfolds, go re-read Atlas Shrugged.

The BP/White House/Gulf Oil Spill Farce Continues

Not only has Obama put a cover on media access and truth proliferation about what is happening in the Gulf right now, but now BP/Obama are outright lying to us. For the last two days a BP official has been all over the financial media extolling the virtues and likely success of the latest capping effort. BP has been running horrifyingly bullshit-filled public relations ads (they should be spending that money helping all those whose lives have been ruined instead of propagating paid masturbation on tv for all to see). I knew that capping effort was failing when I watched BP stock stock plummet toward the end of the day yesterday.

And then I wake up to this:

The plan to start choking off oil gushing into the Gulf of Mexico was suddenly halted as government officials and BP said further analysis must be done Wednesday before critical tests could proceed...No explanation was given for the decision, and no date was set for when testing would begin on the new, tighter-fitting cap BP installed on the blown-out well Monday. (LINK)No comment huh? The comments and propaganda sure flowed liberally over the last two days. At this point we can only assume the worst is going to happen. What that looks like is anyone's guess, but I will put myself out on a limb and say that this catastrophic event - and which has been completely minimized and downplayed by the guy who couldn't run a hot dog stand - is a game-changer for the United States and likely all of the other countries and Islands surrounding the Gulf/Caribbean.

So Obama continues to fiddle while the Empire is being looted and burned.

Tuesday, July 13, 2010

R.I.P. George Steinbrenner (1930-2010)

Love him or hate him, he was provacative and kept baseball interesting

Monday, July 12, 2010

The Eastern Hemisphere Gets Physical

The degree of demand for physical gold from Asia/India can be meausured by the premium or discount to the world spot price in those countries that the buyers are willing pay. This metric is influenced by the nominal price of gold plus the relative value of the country's currency. Up until the paper manipulators decided to hammer on the price of gold last Thursday, these premiums in India, Shanghai and Viet Nam had slipped into negative territory over the past few weeks, indicating no real buying was occuring. This market condition transitioned last week from negative premiums to extremely high premiums, indicating that these countries resumed their importation of gold "hand-over-fist." Market reporting on this is provided by "JB," who publishes his report in the nightly Midas commentary at http://www.lemetropolecafe.com/. It is a very valuable service for gold market participants.

A significant event occurred over the weekend in Viet Nam, that I'm quite confident very few will know about in this country. Viet Nam is quietly the 5th largest "consumer" of gold - very few know that factoid as well. Last week, with the manipulated smashing of gold, the import premium in Viet Nam soared to the extent that the Viet Namese Government signed a decision which allows businesses to resume importing gold (Viet Nam has an active "black market" for gold, but this move legitimizes the buying). Here's a link to the report: Viet Nam Gets Jiggy With Gold In JB's words: "This could provide a useful increment to physical off take. In the right mood Vietnam is a world-class gold importer."

What many who do not follow this market avidly, and what does not get reported in the mainstream media, is that the physical market for gold is starting to overrun the ability of the major Western Central Banks to control the price using the paper market. This dynamic is largely is being driven by large gold buying countries in Asia and by India. Since, I have posted several commentaries on this over the past few weeks, I wanted to post this thesis as expressed by The Daily Bell:

A significant event occurred over the weekend in Viet Nam, that I'm quite confident very few will know about in this country. Viet Nam is quietly the 5th largest "consumer" of gold - very few know that factoid as well. Last week, with the manipulated smashing of gold, the import premium in Viet Nam soared to the extent that the Viet Namese Government signed a decision which allows businesses to resume importing gold (Viet Nam has an active "black market" for gold, but this move legitimizes the buying). Here's a link to the report: Viet Nam Gets Jiggy With Gold In JB's words: "This could provide a useful increment to physical off take. In the right mood Vietnam is a world-class gold importer."

What many who do not follow this market avidly, and what does not get reported in the mainstream media, is that the physical market for gold is starting to overrun the ability of the major Western Central Banks to control the price using the paper market. This dynamic is largely is being driven by large gold buying countries in Asia and by India. Since, I have posted several commentaries on this over the past few weeks, I wanted to post this thesis as expressed by The Daily Bell:

Many in the gold community hadn't actually expected any sort of significant upside for gold and gold stocks until after the FOMC meeting in August, where presumably the Federal Reserve would indicate that it was returning to more money printing operations. But now it would seem there could be significant action in the gold market even before August, given what might be seen as artificial selling pressure.Here is a link to the entire article, which is worth reading: Pressure Builds Underneath The Price Of Gold

Conclusion: Our point here is that once again matters may be moving beyond the elite's ability to maintain control (see other article this issue). At the very least, it is ironic that, given the strength of the market, efforts to restrain the price of gold – whether by manipulation or intimidation – may only end-up reinforcing money-metal price appreciation.

Friday, July 9, 2010

Is George Orwell's "1984" Approaching?

U.S. Tomahawk Missiles Deployed Near China Send Message

Recall that in Orwell's "1984," the world is controlled by three super-states which are at perpetual war with each other. Oceania (Americas, UK/Ireland, Australia and few other areas), Eurasia (Europe, northern Asia) and Eastasia (China, Japan, Korea, northern India).

"Perpetual war?" Think: "War On Terror." The war is about control of the resource-rich areas of the Middle East and Northern Africa. Hmmm...And the three super-states" are dystopic, totalitarian regimes.

I don't know about anyone else, but given that the U.S. system is quickly lapsing into the dystopic state of existence as depicted in Orwell's "Animal Farm," I believe it would be a mistake to dismiss his vision presented in "1984." The contemporary geopolitical developments are becoming stunningly comparative, at least to this observer. That is to assume, of course, that the world does not end up in the state of existence as depicted recently in Cormac McCarthy's "The Road."

It will be interesting to see if China has any response to this development. I'm also wondering if their statement the other day about not engaging in economic warfare using their $900 billion in U.S. Treasury holdings might have been more than coincidental to this development. And then there's this: China Shifting Reserves Into Japanese Govt Debt. There's nothing like gunboat diplomacy...

The power of accurate observation is commonly called cynicism by those who have not got it.

"There's been a decision to bolster our forces in the Pacific," says Bonnie Glaser, a China expert at the Center for Strategic and International Studies in Washington. "There is no doubt that China will stand up and take notice."Here's the article link: A Not-So-Subtle Threat To China?

Recall that in Orwell's "1984," the world is controlled by three super-states which are at perpetual war with each other. Oceania (Americas, UK/Ireland, Australia and few other areas), Eurasia (Europe, northern Asia) and Eastasia (China, Japan, Korea, northern India).

"Perpetual war?" Think: "War On Terror." The war is about control of the resource-rich areas of the Middle East and Northern Africa. Hmmm...And the three super-states" are dystopic, totalitarian regimes.

I don't know about anyone else, but given that the U.S. system is quickly lapsing into the dystopic state of existence as depicted in Orwell's "Animal Farm," I believe it would be a mistake to dismiss his vision presented in "1984." The contemporary geopolitical developments are becoming stunningly comparative, at least to this observer. That is to assume, of course, that the world does not end up in the state of existence as depicted recently in Cormac McCarthy's "The Road."

It will be interesting to see if China has any response to this development. I'm also wondering if their statement the other day about not engaging in economic warfare using their $900 billion in U.S. Treasury holdings might have been more than coincidental to this development. And then there's this: China Shifting Reserves Into Japanese Govt Debt. There's nothing like gunboat diplomacy...

The power of accurate observation is commonly called cynicism by those who have not got it.

- George Bernard Shaw

Thursday, July 8, 2010

Sentiment Indicators Point North For Gold/Silver

I have borrowed this quote from "JB's" daily bullion market report, which can be found every night at GATA's http://www.lemetropolecafe.com/ in the "Midas" report posted under the James Joyce table. (I am not promoting subscriptions to this, but I don't know how any market professional can participate in the metals market without reading this every night).

I wanted to highlight this information because the sentiment indicators tracked by Mark Hulbert tend to be particularly accurate for forecasting contrarian market moves in the precious metals. Per JB: