"Home values are falling at an accelerating rate in many cities across the U.S"

As I parse through the Q4 GDP number released on Friday, the more I understand just how bogus it is. A large part of the input data is based on "estimates" and "assumptions." I would bet we'll see some downard revisions going forward. But one of the biggest components of the economy, especially over the last 10 years, has been homebuilding, home selling and any activity related to those two activities. As readers know, I expect 2011 to be a bad year for home prices. I think a lot of people will be in for a very rude surprise in this regard.

So I wanted to highlight this online Wall Street Journal article from today. Here is the LINK. This article reaffirms a previous post of mine this month that foreclosures, inventory and lack of credit-worthy buyers will force housing prices much lower for the foreseeable future:

Market conditions could get worse in the months ahead. Millions of homeowners are in some stage of foreclosure or are seriously delinquent on their mortgages, and millions more owe more than their homes are worth. Real-estate agents are bracing for an uptick in distressed properties hitting the market, including foreclosures being sold by banks and homes sold by owners via a short sale, in which banks agree to a sale for less than the amount owed.The dynamic described in that quote is going to accelerate this year, as people continue to lose jobs, unemployment benefits expire and banks are forced to convert serious delinquencies into foreclosures. How can the Government prevent this? By using Fannie Mae and Freddie Mac to monetize the delinquency and foreclosure problem. This could happen but it is more likely that those two GSE's will be used to monetize the debt after the properties are transfered to the banks. This of course will entail QE3, 4, etc. and, of course, much higher gold/silver prices.

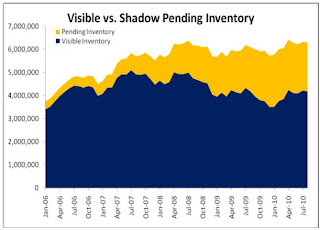

The other issue which is harder to prove is the "shadow" seller. The seller who wants to sell but decides to wait "for the market to come back" or can't sell for a price that takes out the mortgage on the house. But this article reaffirms my point:

Some sellers have opted to pull their homes from the market rather than lower their prices, either because they believe values will improve or because cutting the price would mean selling for less than the amount owed to the bank.Anectdotally around the Denver area, I am starting to see more "for sale" signs pop up again (some of it early seasonal), more "price reduced" signs and a lot more "for rent" signs. The latter being people who want to sell but can't or want "to wait for the market to come back."

The housing problem is causing a lot of pain in this country. Unfortunately, I believe we are entering into an "acceleration" phase, as a larger percentage of homes decline in value to a level below the outstanding debt on the property. I heard an ad from a large Denver mortgage broker last week advertising a 105% of value Fannie Mae refinancing product designed to allow homeowners to consolidate a 1st and 2nd mortgage into one. This is just one more indication of the Government "kicking the can down the road," as it means that the policy-makers are willling to use Taxpayer money to try and fix a problem that can only be fixed by the laws of supply and demand.

.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)