By now everyone has seen the reports of the unexpected decline in Q4 GDP reported yesterday. Of course, the decline was blamed by the White House and the media on a decline in Government spending. But I wanted to bring to everyone's attention the truth about this. If you pull up this link: Fact Check, you'll see that the Govt actually spent about $98 billion more in Q4 than in Q3. In addition, the Government rang up a $292.2 billion spending deficit. So I wonder what the real culprit was for the Q4 GDP contraction. Pretty much has to be autos and housing. I would recommend reading that link, but you can do the Government spending numbers yourself here: LINK

Tomorrow we have the Government's non-farm payroll report for January. Quite honestly I haven't paid much attention to this number for the past few years other than to dissect out where the inconsistencies are with the report and the real world. One of the primary numbers I look at is the labor force participation rate, which is the percentage of the population that is "eligible" to participate in the Government defined labor pool as a percent of the total working age population. This metric is currently about as low as it was back in the early 1980's, meaning that the number of people working and paying taxes is significantly lower as a percent of the total population now than back then. The significance of that metric and the ramifications for further Government deficit spending and Treasury debt issuance to fund that spending are pretty obvious.

That aside, I saw an article about which of the big box retailers would be closing the most stores this year. Barnes and Noble, Office Depot, JC Penny, Sears and Best Buy are closing anywhere from 10-20% of their store base. That's quite a bit of lost jobs to start the year: LINK

Again, regardless of what the Government shows for jobs added tomorrow, keep in mind that as big retailers close stores, they cut their workforce. And this list is just the top-5 expected closings. I expect we'll see a lot more over the course of the next few months. When retail sales are slow, it means the consumers are tapped out - or maxed out on debt - and the economy is weak or in a state of general decline.

And of course, when big box retailers close down a lot of stores, it adds to the growing glut of commercial real estate.

Just a little truth tidbit if you're worried about the latest sell-off in the price of gold/silver. There's a lot of misinformation, disinformation and absurd ideas about what's going in the market. The truth is that the eastern hemisphere countries are vacuuming up physical gold and silver that they are having delivered domestically as quickly as the London/New York dealers are printing paper gold and silver contracts. You can see this in any given 24 hour trading period, where the price of the metals rises overnight until Hong Kong closes and London opens. Then the price sells off as the London/NYC bullion banks print up more paper contracts and dump them on the market.

In fact, per today's Comex open interest report, currently there are about 13,900 contracts February open and potentially standing for delivery. This represents 63% of the gold listed as available for delivery on the Comex. This is an extraordinarily high amount in relation to the historical context at this point in any given delivery month cycle (first notice day). We'll see how this unfolds, but I doubt Marketwatch, Bloomberg News and CNBC are reporting this information.

One more point of thought regarding yesterday's GDP report. The Government used a .6% inflation assumption (that's point six percent, annualized) in calculating Q4 GDP. Anyone out experience only a .6% increase in their necessities last year? Imagine how negative the GDP report would have been if the Government used a realistic inflation index...

Thursday, January 31, 2013

Monday, January 28, 2013

Are The Currency Wars For Real?

I thought it appropriate to start this piece with a quote from Ludwig

Von Mises regarding the global system of "flexible" currencies:

A general acceptance of the principles of the flexible [currency] standard must therefore result in a mutual overbidding between the nations. At the end of this race is the complete destruction of all nations' monetary systems. LINK

That was written in 1949 and essentially prophesied the eventual global currency war that Von Mises visualized unfolding, as countries used currency devaluation strategies in a desperate attempt to prop up their own crumbling economic systems and "protect" their relative export power.

I am not alone in thinking that we entering a very real and very dangerous global currency war. The highly regarded Comstock Partners issued their view on this four days ago: "If we are correct, the U.S. and global economies will contract and there will be a race to the bottom with "competitive devaluations" rampant. All the countries that need exports for economic growth will be very aggressive in the race to the bottom..." LINK.

I remember when I first started looking at the precious metals back in 2001. I read one of James Dines newsletters at the time in which he was promoting gold and mining stocks as the ultimate defense against a global race to devalue currencies to zero. At the time I was unaware that his vision was based on the work by Von Mises fifty years earlier.

Essentially, in a system of flexible, floating national currencies, the currency of each nation achieves relative value in relation to the other currencies based on either relative economic strength or relative supply of the currency. With the weak global economy, nations have resorted to devaluing their own currency in an attempt to keep their respective systems from falling apart from the burdens of too much debt and as a means of making their exports relatively cheaper. The latter strategy is also an attempt to stimulate domestic manufacturing by stimulating foreign demand.

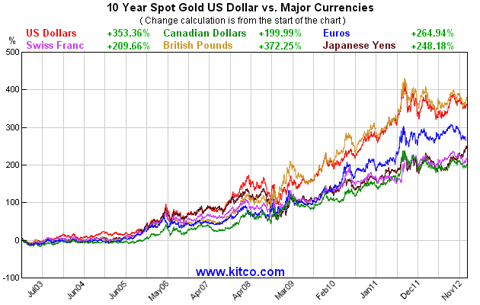

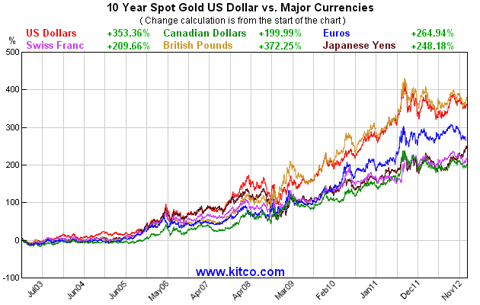

The preferred method of currency devaluation has been through prolific use of the printing press, aka "QE." As you can see from the two charts below, this process of devaluation has actually been occurring since the start of the new millennium:

(click to enlarge)

This chart shows the rise in the price of gold over the last 10 years relative to the world's major currencies. Regardless of whether anyone wants acknowledge a general global monetary policy of currency devaluation, there's no question that all the major global currencies are being devalued relative to gold (the same is true vs. the Indian rupee - link, and the Chinese yuan - link).

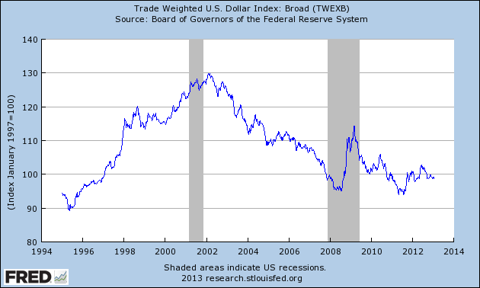

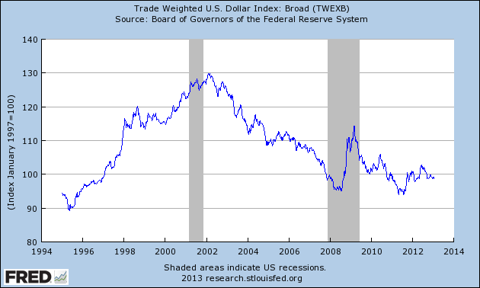

The second chart shows the decade-long currency devaluation of the U.S. dollar:

(click to enlarge)

This chart shows the trade-weighted U.S. dollar index, which is considered to be a better indicator of the overall purchasing power of the U.S. dollar relative to the rest of the world. This index includes 26 different global currencies, as opposed to the standard USDX, which is just six (euro, pound, yen, Canadian dollar, Swiss dollar and Swedish krona). As you can see, the relative global value of the U.S. dollar has declined over 30% since 2002.

Currency war or no currency war?

As you can see from the above charts, clearly the world's major currencies are in decline vs. gold, and the U.S. dollar has been in serious decline vs. a broad basket of global currencies. But what to make of all this "noise" in the media about a "global currency war?" After, the just five days ago the chief of economist of the IMF issued a statement saying that "[t]his increasing talk of currency wars is very much overblown" LINK

Usually when a high-ranking public official makes a point of officially deny something, it's worth taking a look beneath the surface to see if there's any substance behind the denial.

Ironically, one day after the IMF chief economist made that statement, Bloomberg News conducted an interview with George Soros in which he specifically referenced the process of ongoing global currency devaluations: LINK I would like to note here that back in November is was widely reported that Soros was actively adding to the big position in his funds: LINK. Presumably he is doing this as a mechanism to profit from global currency devaluations per the gold/currency chart above.

In addition, several major countries have issued there own warnnigs about the ongoing sovereign currency depreciation and its contribution to an escalating global currency war. Two days ago Saudi Arabia issued this statement: "Devaluation of currency by certain countries to make them more competitive in the global market has raised fears of a "currency war'" LINK

And this morning I woke to find these news reports issued respectively from economic leaders in Japan LINK, Swizterland LINK and South Korea LINK. Each article either directly or indirectly references specific actions being taken to devalue the respective county's currency. In the South Korean report, a Central Bank member specifically references the outbreak of a currency war.

So there it is all laid out. I'll leave it to the reader to decide for themselves whether or not they want to believe that the Von Mises proposition is unfolding before our very eyes. I will say that it appears to me as if the Jim Dines forecast of a coming race to devalue global currencies (mentioned above) that I read in 2001 looks to be very real and in motion. It also appears that the best way to defend your wealth against this insidious paper currency devaluation is to buy gold and silver. I always recommend buying the physical metal and taking delivery of it in some form, as opposed to buying the paper forms like GLD and CEF or buying into these "fractional" bullion paper accounts being promoted by Kitco and Monex.

A general acceptance of the principles of the flexible [currency] standard must therefore result in a mutual overbidding between the nations. At the end of this race is the complete destruction of all nations' monetary systems. LINK

That was written in 1949 and essentially prophesied the eventual global currency war that Von Mises visualized unfolding, as countries used currency devaluation strategies in a desperate attempt to prop up their own crumbling economic systems and "protect" their relative export power.

I am not alone in thinking that we entering a very real and very dangerous global currency war. The highly regarded Comstock Partners issued their view on this four days ago: "If we are correct, the U.S. and global economies will contract and there will be a race to the bottom with "competitive devaluations" rampant. All the countries that need exports for economic growth will be very aggressive in the race to the bottom..." LINK.

I remember when I first started looking at the precious metals back in 2001. I read one of James Dines newsletters at the time in which he was promoting gold and mining stocks as the ultimate defense against a global race to devalue currencies to zero. At the time I was unaware that his vision was based on the work by Von Mises fifty years earlier.

Essentially, in a system of flexible, floating national currencies, the currency of each nation achieves relative value in relation to the other currencies based on either relative economic strength or relative supply of the currency. With the weak global economy, nations have resorted to devaluing their own currency in an attempt to keep their respective systems from falling apart from the burdens of too much debt and as a means of making their exports relatively cheaper. The latter strategy is also an attempt to stimulate domestic manufacturing by stimulating foreign demand.

The preferred method of currency devaluation has been through prolific use of the printing press, aka "QE." As you can see from the two charts below, this process of devaluation has actually been occurring since the start of the new millennium:

(click to enlarge)

This chart shows the rise in the price of gold over the last 10 years relative to the world's major currencies. Regardless of whether anyone wants acknowledge a general global monetary policy of currency devaluation, there's no question that all the major global currencies are being devalued relative to gold (the same is true vs. the Indian rupee - link, and the Chinese yuan - link).

The second chart shows the decade-long currency devaluation of the U.S. dollar:

(click to enlarge)

This chart shows the trade-weighted U.S. dollar index, which is considered to be a better indicator of the overall purchasing power of the U.S. dollar relative to the rest of the world. This index includes 26 different global currencies, as opposed to the standard USDX, which is just six (euro, pound, yen, Canadian dollar, Swiss dollar and Swedish krona). As you can see, the relative global value of the U.S. dollar has declined over 30% since 2002.

Currency war or no currency war?

As you can see from the above charts, clearly the world's major currencies are in decline vs. gold, and the U.S. dollar has been in serious decline vs. a broad basket of global currencies. But what to make of all this "noise" in the media about a "global currency war?" After, the just five days ago the chief of economist of the IMF issued a statement saying that "[t]his increasing talk of currency wars is very much overblown" LINK

Usually when a high-ranking public official makes a point of officially deny something, it's worth taking a look beneath the surface to see if there's any substance behind the denial.

Ironically, one day after the IMF chief economist made that statement, Bloomberg News conducted an interview with George Soros in which he specifically referenced the process of ongoing global currency devaluations: LINK I would like to note here that back in November is was widely reported that Soros was actively adding to the big position in his funds: LINK. Presumably he is doing this as a mechanism to profit from global currency devaluations per the gold/currency chart above.

In addition, several major countries have issued there own warnnigs about the ongoing sovereign currency depreciation and its contribution to an escalating global currency war. Two days ago Saudi Arabia issued this statement: "Devaluation of currency by certain countries to make them more competitive in the global market has raised fears of a "currency war'" LINK

And this morning I woke to find these news reports issued respectively from economic leaders in Japan LINK, Swizterland LINK and South Korea LINK. Each article either directly or indirectly references specific actions being taken to devalue the respective county's currency. In the South Korean report, a Central Bank member specifically references the outbreak of a currency war.

So there it is all laid out. I'll leave it to the reader to decide for themselves whether or not they want to believe that the Von Mises proposition is unfolding before our very eyes. I will say that it appears to me as if the Jim Dines forecast of a coming race to devalue global currencies (mentioned above) that I read in 2001 looks to be very real and in motion. It also appears that the best way to defend your wealth against this insidious paper currency devaluation is to buy gold and silver. I always recommend buying the physical metal and taking delivery of it in some form, as opposed to buying the paper forms like GLD and CEF or buying into these "fractional" bullion paper accounts being promoted by Kitco and Monex.

Friday, January 25, 2013

The Government's War On The Truth

The classical or orthodox gold standard alone is a truly effective check on the power of the government to inflate the currency. Without such a check all other constitutional safeguards can be rendered vain. - Ludwig Von Mises, "The Theory of Money and Credit"Well, we saw evidence last week that Von Mises was right about fiat currency and constitutional safeguards when nearly every Congressman voted in affirmation - and Obama immediately signed - a law which makes it illegal to have an organized protest in any location where Secret Service personnel are going to be hanging out: LINK Punishable by up to 10 years in prison. Think about this Occupy and Teabag people, if the Government knows in advance of one of your protest gatherings, they'll send some Secret Service people to that location and this law says the local police can arrest you if you show up to have your gathering. I guess in the course of his Constitutional Law studies, Obama forgot to study the 1st Bill of Right - aka the 1st Amendment. Bush referred to the Constitution as merely a piece of paper, Obama has waged a serious war against the Constitution.

(Note: subsequent to my writing this, new home sales for December were reported: plunged nearly 8% and the seasonally adjusted annualized number missed expectations by nearly 20,000 homes)

The housing market has been highly promoted by the media, the Government and Wall Street as "in recovery mode." I've been working on an in-depth piece on the housing market but it's taking more time than I expected. In the course of my research, I've come up with some interesting tidbits that I'll share now. First, it was reported yesterday that Robert Shiller, regarded for some reason as the foremost housing market expert (I guess in the same vein that Bernanke is considered the leading expert on Depression avoidance), stated that the housing market decline could resume: LINK Ya no kidding. In fact, without the help of $100's of billions of Government and Fed subsidies since 2009, it's likely that housing would already be a lot lower.

I want to present just one chart that refutes the notion that the average person in this country is in any kind of position to help support any kind of meaningful housing recovery:

Consumer Debt (click on chart to enlarge)

Hmmm...what happened to the idea that consumer was "deleveraging?" This chart - from the Fed database, seems to refute that notion. We know that the size of the labor force continues to shrink. We also know that on an inflation-adjusted basis, real income is declining. Now we see that consumer debt levels are rising quickly. Let me ask this simple rhetorical question: how on earth can there possibly be any kind of real housing market recovery given the above facts?

One more quick note on yesterday's jobless claims number. The Government report noted that the data included "estimates" of the jobless claims filings in California, Virginia and Hawaii. There's no way in hell that yesterday's supposedly "good" report had any kind of statistical validity. It's just another example of the media spin and an increasingly Orwellian Government.

Before I finish for the weekend, I thought I'd leave you all with some Friday chart porn:

(click on chart to enlarge)

In other words, don't sweat this latest attempt by the Government/Fed to knock down the price of gold and silver, the trend is your friend and this is nothing but another in the long line of tremendous buying opportunities. Unlike the extreme hubris exhibited by Obama/Bernanke, we all should be a little grateful that these attacks on honest money occur because it enables us all to exchange our increasingly devalued fiat dollars for true money. Have a great weekend.

Tuesday, January 22, 2013

Realities Of The Physical Silver Market And The Economy

Printed money is like heroin, the patient needs bigger and bigger doses until it finally kills him or makes him totally dysfunctional. And this is what is happening to the world economy. Government benefits are increasing and the people are in need of even greater stimulus as unemployment escalates. - Egon Von Greyerz, Matterhorn Asset ManagementWe are starting to see the unmistakable signs of the law of supply and demand gripping the market for physical silver. By this I mean the endless of supplies of paper fiat currency chasing after the relatively fixed supply of physical silver. Last week the U.S. Mint announced that it had run out of its initial production of 2013 Silver Eagles and that new shipments would not be available until late January. This is just one of many examples.

What this means is that we are going to see a much higher price for silver over the next several months, as the Comex paper market bullion bank manipulators begrudgingly retreat in order to allow a higher market price to possibly induce some supply from existing holders how bought at lower levels.

I discussed this topic in an article over the weekend published by Seekingalpha: LINK

On another topic, it looks like the economic numbers are starting to reflect the economic downturn that I've been expecting and have been forecasting on this blog. The not widely followed/reported Chicago Fed National Activity Index came in at .02, significantly below the expected reading of .28. Uglier, the 3-month moving average was -.11. This index is a weighted average of 85 monthly indicators of national economic activity.

In addition, the more widely watched/reported Richmond Fed business activity index literally plunged to -12 in January from an expected reading of 5 and a December reading of 5. It was the biggest miss vs. expectations since September 2009: LINK

Finally, existing home sales dropped 1% in December. This is based on a seasonally adjusted annualized number, so theoretically December's seasonal effect is washed out of the calculation. I haven't had a chance to run through the actual numbers to see what the real number looks like, but no doubt they are not good. The excuse being given is a lack of inventory, especially at the lower end. All that means is that big investment funds have stopped buying blocks of crappy low end homes because the rental market is starting to saturate. I know this is for a bona fide fact in Denver. More on housing soon, as I'm working on a big report about it. Soon the music will stop and a lot of the "speculators" who have appeared this year buying and flipping will be left holding homes they can't sell.

What all this means is that we can expect a continued increase in the supply of printed paper money as the Fed/Government policy makers desperately try to artificially stimulate/revive demand. The paper money will continue chasing the dwindling availability of physical gold/silver to higher price levels. Don't blame me if you are left holding bundles of paper dollars and are having a hard time finding physical gold/silver to buy with it at some point down the road.

Saturday, January 19, 2013

Any Questions As To WHY Germany Wants Its Gold?

[The Bundesbank] isn't getting what they want, the Federal Reserve is telling them what they can have. The fact that they're doing it over 7 years instead of 7 weeks, to me, is just an indication that that gold probably isn't in the Federal Reserve and the Federal Reserve doesn't want to have to go out and buy it overnight to fulfill the German demand. They are trying to stretch it out as long as possible in order to keep gold prices controlled. James Turk on King World NewsYou can listen to the above interview here: LINK (highly recommended). Mr. Turk's viewpoint echoes that of many of us who have studied the gold market for quite some time, including the paper vs. physical issue which is at the heart of the topic.

With that said, the debate is now getting into the mainstream media. I was quite shocked to see that CNBC enabled this very debate to air on its programming, especially given that CNBC had GATA's Bill Murphy on in February 1999 - only to never invite him back again after he discussed some of the issues in the video below from yesterday:

One thing that has taken me by surprise are the sudden and unexpected developments that have instantly thrust the physical vs. paper issue into the forefront. The Bundesbank event followed by the U.S. Mint announcement has made a much wider audience more open minded about the issues surrounding credibility of bullion bank gold/silver depositories and the ability to verify whether or not the gold/silver that is supposed to be in those depositories can be fully accounted for on an allocated basis.

Certainly the circumstances surrounding the Bundesbank's decision and the length of time being given to fulfill it's request adds credibility to the view that western Central Bank and bullion bank depositories do not have the amount of gold they are supposed to be holding on behalf of others...

Thursday, January 17, 2013

Germany Pays A Visit To The United States

Press Release from the Bundesbank: LINK

Knock Knock.

Ben Bernanke: Who's there?

Bundesbank (German Central Bank): We would like our gold

back please.

Ben Bernanke: ROFLMAO

(note: "roflmao" is texting-code for, "rolling on floor, laughing my ass off")

Here's what Jame Turk has to say about this - for the record, in studying/researching the gold market exclusively for the better part of 12 years, I believe Turk knows as much as about the subject of Central Bank gold manipulation as anyone I've encountered:

The most likely scenario is that, while it's possible, though not a certainty, that the bars may be sitting in the West Point deep storage Fed gold vault, it has been leased out and swapped out in legal transactions designed to manipulate the price of gold. What this means is that private parties (think: China's central bank, very wealthy foreigners, India, etc) have the legal title to any gold that has been leased or swapped and sold outright.

If you are skeptical as to the credibility of this reality, please take the time to read this paper authored by James Turk in January 2002 - it is quite revealing: Fed Gold Swaps

It’s quite clear that the German gold is being held hostage. They are not getting what they want. They are getting what the Federal Reserve is telling them they can have. The fact that they are doing it over 7 years rather than 7 weeks, is just an indication that gold probably isn’t in the Federal Reserve, and the Federal Reserve doesn’t want to have to go out and buy it overnight to fulfill the German demand. They are trying to stretch it out as long as possible in order to keep gold prices controlled.Here's the link to his interview with Eric King: LINK

The most likely scenario is that, while it's possible, though not a certainty, that the bars may be sitting in the West Point deep storage Fed gold vault, it has been leased out and swapped out in legal transactions designed to manipulate the price of gold. What this means is that private parties (think: China's central bank, very wealthy foreigners, India, etc) have the legal title to any gold that has been leased or swapped and sold outright.

If you are skeptical as to the credibility of this reality, please take the time to read this paper authored by James Turk in January 2002 - it is quite revealing: Fed Gold Swaps

Wednesday, January 16, 2013

Global Gold Demand: Fact vs. Fiction

Will gold and silver follow the same pattern twice-repeated over the past decade so that we can expect outsized price gains in the precious metals the next two years? Yes, I think so because gold and silver remain undervalued, and the world's monetary and financial problems have not been solved. The correction is now over, the new floor is in place, and investors should expect to see spectacular moves for gold and silver over the next two years. - James Turk, King World News (KWN)Recently there has been a lot of "noise" about the level of global gold demand. A lot of the so-called "data" comes from the World Gold Council, which because of its name is considered an authority on annual supply/demand data. But in studying this sector as closely as I have for the past 12 years, I can't find anyone considered knowledgeable who thinks the WGC's data is reliable. For instance, in general the WGC is nothing more than an de facto industry association for the global jewelry business, and most of its data reflects demand data from that segment of the market. They completely ignore the voracious ongoing accumulation by many big Central Banks. The truth is, no one really knows for sure just how much gold is being "consumed" globally both overtly and covertly.

I wrote a piece addressing this issue, mostly in response to a piece posted on Seekingalpha last week making the claim that lowered gold demand would lead to lower gold prices. The article relied heavily on source links that referenced the World Gold Council numbers:

As you can see, the truth stands much larger than myth. The demand of gold/silver is not only unequivocally not in decline, it is in fact globally getting even stronger. This will underscore what I expect to be a significant price rise in gold and silver during 2013.Here's the link: Lack Of Demand....?

The one thing I can say for sure: the fact that gold has gone up every year for the past 12 years, despite the heavy headwinds of western Central Bank/Government price suppression schemes, is evidence alone that the demand for physical gold is far greater than the supply. Moreover, the supply of printed fiat currencies of all nationalities is accelerating. It is this increasing supply that will push the relatively fixed supply of physical gold and silver a lot higher over the next several years.

Friday, January 11, 2013

Charles Plosser's Follies And Making Money Off Of Them

There are REAL laws in both the physical and the economic spheres. In both cases, they must be obeyed in order to be commanded. A plane does not fly by “ignoring” the law of gravity. A nation does not grow prosperous by “ignoring” the law that says that what is consumed must first be produced. - Bill Buckler, The Privateer (#719)I s'pose I would be remiss if I didn't make some comment about the Denver Bronco/Baltimore Raven Divisional playoff game being played tomorrow at Mile High Stadium. So I will: It's going to be very cold (forecast: 17 degrees). If one were to bet the game, I would bet the "under" (44 1/2) and lay the points (-9 1/2). A lot is being made of the fact that Peyton Manning is 0-3 in cold weather playoff games. Pshaw. All of the games were obviously on the road, two in New England. I will counter by saying that Peyton never played on a team with the #2 ranked defense in the league going into the game...

At any rate, some of you may have noticed the paper hit put on the precious metals once again today after the Comex opened. The catalyst was some ridiculous comments by the Philadelphia Fed's Charles Plosser. I responded in kind to his idiocy:

Please tell me, Mr. Plosser, where exactly is this GDP growth of 3% going to come from given that the trend in GDP going into 2013 is declining, 1% or less and the main driver of GDP over the last 12 years - consumption - is quickly eroding?You can read my commentary here: LINK

I discuss some trading ideas that we implemented yesterday and for which we used Plosser's mind-numbingly absurd statements to take advantage of the market's illogical response. This is just one of those days where understanding our Orwellian system makes it a little easier to make money if you know how to take advantage of it. Have a great weekend.

Wednesday, January 9, 2013

The Gold Bull Stage 2: Here Come The Pensions

Pension money invested in bullion is 'peanuts' at the moment...If 1 percent of their total assets shift to the metal, the gold market would explode. - Itsuo Toshima, advisor to Japanese pension funds (Bloomberg, link provided below)I have maintained since 2002 that the precious metals and mining stock market would eventually erupt into bull market frenzy that would at least rival, and likely succeed, the bull market frenzy we saw in tech stocks. Part of what will fuel this frenzy is the enormous flow of institutional investor money, globally, that will eventually find its way into the precious metals and mining stock sector. Because the amount of potential capital from institutions from just a small increase in sector allocation - relative to the total size of the precious metals/mining stock sector - the price effect is potentially enormous.

There are a lot of solid fundamental reasons for this. But from a technical perspective, the total size by market capitalization of the gold, silver and publicly traded mining stocks combined is absolutely minuscule in relation to the total size of global investible institutional assets. To put this in perspective, the market cap of each of the top 15 stocks in the S&P 500 is individually larger than the total market of the entire publicly traded mining stock sector (1). Think about that for a minute. Apple has a bigger market cap than every single mining stock globally combined.

(1) I get this number by taking the total market cap of all mining stocks globally as of March 2009, calculated by Ibbotson & Assoc of $150 billion LINK, and grossing this number up by 25%, which is a blended rate of appreciation between the XAU and the Canadian Venture Exchange, which is the commonly accepted benchmark for junior mining stocks. The market cap of the 15th largest stock in the SPX is $204 billion: LINK.

Interestingly, if you think about it, to what extent can Apple possibly achieve even more market penetration and customer-base growth over the next 5 years? It is likely that Apple's market saturation and ability to innovate and create demand has plateaued. At very best, its growth curve has largely flattened. The ole law of diminishing marginal returns - yes, it's a bona fide law of economics/nature - had to get its claws into Apple eventually. Apple stock happens to be the largest holding across all hedge funds.

Now compare that to gold, silver and mining stocks. This visual should help:

(click on chart to enlarge)

Compared to Apple on a relative basis, the "market penetration" into the precious metals sector by institutional investors is quite tiny and there is significant room for institutions to move into and saturate the precious metals sector.

Now, compare this global asset allocation to the last bull market peak for precious metals back in 1980. Back then precious metals represented 6% of total global assets invests. In other words, the amount of global cash invested in precious metals on a relative basis was 6 times greater than it is today. By this measure alone, not only is the precious metals sector unequivocally not in an investment bubble, but it is absurdly undervalued.

I bring this up because it now appears as if the precious metals sector is starting to get the attention of the big institutions. Certainly everyone is now aware that Pimco's Bill Gross was quite vocal in advocating gold during 2012, including his latest comments: LINK

Pimco manages about $2 trillion. The total market value of ALL of the gold held at the Comex, including the customer gold that is not available for delivery, is $18 billion. If Pimco were to allocate 5% of its asset base to buying physical gold, that amount ($100 billion) is 5 times greater than all of the gold held at the Comex. That's just one U.S. institutional investor.

Interestingly, I saw a story posted on Bloomberg late last night about the movement of Japanese pension funds into gold:

Japanese pension funds, the world's second-largest pool of retirement assets after the U.S., will more than double their gold holdings in the next two years as the new government pushes for a higher inflation target, according to an adviser to the funds.Here's a link to the article: Gold Lures Japan's Pension Funds

Japan's new Prime Minister has explicitly stated that he will implement whatever monetary policy is required to stimulate a 3% inflation rate. The pension funds are responding in kind by moving into gold.

This is just getting started on a global institutional investor basis and it's in its nascence in the United States. Japanese pensions have $3.36 trillion (U.S. dollars) under management. This number in the U.S. is over $20 trillion (Rockefeller Foundation).

So Pimco alone can wipe out the Comex 5 times over with just a 5% allocation to gold. Consider that the total market capitalization of all publicly traded mining stocks is around $200 billion, with the top 5 stocks comprising a large portion of this. Now run the scenario if just U.S. and Japanese institutional investment managers allocate 5% of their portfolios to gold and mining stocks.

You can see where this analysis is headed. This is not my original thinking, as I vividly recall James Dines (The Dines Letter) laying out the case for this sector back in mid-2001, and stating that the eventual bull run in the precious metals/mining stock sector would dwarf the bull run we saw in internet/tech stocks.

The bottom line is that, typically, with big institutional money managers, an investment trend starts slowly and then happens all at once. It is a herd of cattle that you want to be positioned aggressively in front of before the stampede starts. Based on the murmurs being made by the money managers like Bill Gross and by the Japanese pension investors, I would say that the cattle are looking at the open gate and getting ready to make a run for it.

Saturday, January 5, 2013

Friday, January 4, 2013

The Big Lie

A lie always contains a certain factor of credibility, since the great masses of the people in the very bottom of their hearts tend to be corrupted rather than consciously and purposely evil, and that, therefore, in view of the primitive simplicity of their minds, they more easily fall victim to a big lie than to a little one, since they themselves lie in little things, but would be ashamed of lies that were too big - Adolph Hitler, "Mein Kampf"Most of you are aware by now that the FOMC minutes for the December meeting released yesterday contained a statement that suggested more FOMC members were interested in ending the Fed's bond buying progarm - aka QE - by the end of 2013. The precious metals were immediately hammered, while there was very little reaction in the bond market and no reaction in the S&P 500 or the housing stocks. Hmmm.

There's two problems with the above. First, if it were indeed true about the Fed ending QE by the end of 2013, think about what that would mean for interest rates, mortgage rates, the housing sector and the economy overall. If the Fed stopped buying Treasury and mortgage bonds, interest rates would spike up several hundred basis points and the economy would really tumble off the cliff.

Second, who will buy all the new Treasury debt issuance? The Fed has purchased well over 50% of all new Treasury issuance in the last three years. If there Fed were not buying this paper, who would? Seriously. Either future Treasury bond auctions will fail OR it will take significantly higher interest rates to induce new money into Treasuries to make up for the trillions the Fed has been buying. Or, of course, the Government will balance its spending and won't require additional Treasury issuance...I would lay all my money on any bet that the latter will never happen.

So I guess the FOMC minutes were a big lie. It's not the first time the Fed has suggested that QE would not continue, only to be expand it within 6-9 months. Government deficit spending = de facto QE. The second Big Lie today was with the BLS employment report. As it turns out, I found a big gaping hole in the employment report today and I have not seen anyone question the number in any of the prolific material which explains why the BLS employment report is fictitious.

You can read my analysis here: The Big Gaping Hole In The BLS Jobs Report

Needless to say, the Fed has already committed to buying a $trillion more in Treasury and mortgage debt in 2013, and unless the Fed is prepared to shoulder the consequences of ending that program rather than expanding at the end of 2013, yesterday's plunge in precious metals can be seen seen as a true gift from the markets by anyone who takes advantage of it.

Wednesday, January 2, 2013

The Fiscal Cliff And Gold

America will endure until the day Congress discovers that it can bribe the public with the public's money - Alexis de TocquevilleI mentioned twice in November that the Fiscal Cliff would be averted with a last minute deal that would postpone America's budgetary day of reckoning. And of course the clowns in Congress and in the White House once again did not fail to disappoint.

I just came across a fact about that new agreement that you will definitely NOT see mentioned in any of the mainstream media - yesterday's deal included an extenstion of a big tax break for Hollywood: Movie Mogul Tax Break and for Warren Buffet: And For Railroad Owners The latter will benefit Phil Anschutz, Denver's local zillionaire. I guess Buffet's big fundraising dinners for Obama paid off nicely. I'm sure Phil takes care of the The Big O as well.

At any rate, I wrote piece published on Seekingalpha that explains why yesterday's Cliff deal will help grease the set-up for the next big run in gold/silver: "the Fiscal Cliff deal will now lead to a much higher Treasury debt limit ceiling - if not the complete elimination of it, which has been proposed by Obama - and a much higher level of QE. How do you invest knowing this ahead of time?" Here's the LINK

Next on deck will be the dealings over the debt ceiling limit, which was breached in late December. You can be sure that Congress will pass a huge ceiling raise, if not a total elimination of the ceiling, because otherwise they won't get their paychecks and Harry Reid, John Boehner and Nancy Pelosi will have to furlough their limo drivers...

Subscribe to:

Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)