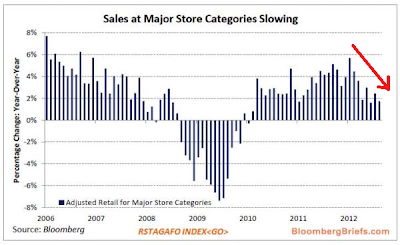

We have reached a profound point in economic history where the truth is unpalatable to the political class - and that truth is that the scale and magnitude of the problem is larger than their ability to respond - and it terrifies them...Bad things are going to happen. - Hugh Hendry on CNBCOnce again we're going through another wash, rinse, repeat cycle with the housing market fairy tales. People who bother to pay attention to the news woke up this morning to a report from the Commerce Dept that housing starts rose the highest level since 2008 in June LINK. I'm not sure why that would be considered good news, since 2008 is when the bottom really fell out of the housing market. The other anomaly that contradicts this Government-compiled data is that mortgage purchase applications continue to decline on a weekly basis. Note: the mortgage application data is compiled and released by a private, free enterprise organization so we can safely assume that the data report is infinitely more reliable than that of the Government's Commerce Department.

The other myth being propagated by the media and the economic wizards is that the housing inventory is declining. In fact, this housing inventory has largely been converted to rentals. In particular Fannie Mae and Freddie Mac have been unloading their foreclosed inventory into institutional investors using Taxpayer money to subsidize the transactions. Interestingly and anecdotally, I was perusing the home rental listings in the Denver area for a friend who may be moving to Denver and I noticed that rents had decreased by about 10% from just 6 months ago, when I was looking for a new rental. If in fact the total housing inventory, for sale + rentals, was declining then we would expect that rents would be stable or increasing.

So where's the black hole disconnect? For one, the data is highly suspect, especially since mortgage purchase applications do not correlated with sales and starts. To be sure, I'm sure home builders are taking advantage of near-zero interest rates and borrowing as much as they can to build. But, as zerohedge crunched this morning's housing starts numbers, the number of homes actually completed is well below the run-rate of starts: LINK. A form of "channel stuffing" for home builders is to start a lot of homes but take a long time to complete them, since the stock market and investors only care about the headline "starts" data.

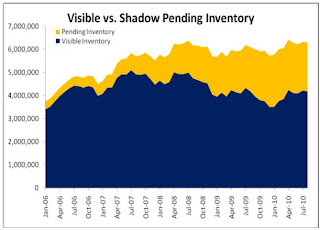

Even uglier, the "shadow" inventory of housing market is going to start rising rapidly this year. The "shadow" inventory primarily is composed of homes in which the homeowner is in some form of delinquency or technical default. These are homes where the lender/bank has opted to sit on the non-paying mortgage rather take on the ownership responsibilities of foreclosing, primarily real estate tax and HOA dues expenses. If banks thought they could foreclose and sell quickly without incurring a big capital hit, they would. But instead they let the homeowner live "rent free" but still on the hook for taxes and HOA dues. This is especially true in the jumbo-mortgage segment (anything over $417k). In fact, I know of several people who are sitting in high 6-digit and low 7-digit value homes who have not made mortgage payments for at least a year.

These delinquent/default mortgage homes are just part of the shadow inventory. The other primary part is actual foreclosures. We had a moratorium in foreclosures while the mortgage fraud litigation was being settled, of course on favorable terms for the banks. FNM/FRE also delayed their foreclosure process while they unloaded substantial REO on the market. So what is the data showing us? From Bloomberg:

The shadow inventory of homes – those in foreclosure plus those 90 days late on mortgage payments – is on the rise again, a further indication that the supply side has not yet healed. According to RealtyTrac, foreclosure starts jumped 6 percent on a year ago basis in the second quarter, the first year-over-year increase since 2009. There are roughly 4.16 million homes that could begin to flow to market.What's even more troubling is that the Government's FHA filled in the lending void created by the massive financial troubles at FNM/FRE. In fact, over the past few years, the Government subsidization of the housing market shifted from FNM/FRE to the use of the FHA. The FHA became the predominant source for mortgages and rolled out several no-down-payment/3.5% down payment programs. And now, predictably FHA delinquencies are rising quickly, up a frightening 26% from last year: LINK. Why is this "frightening?" One, because it means that the FHA will be forced to foreclose on a huge number of homes, further contributing to the housing market inventory; and two, because the FHA is going to require a massive taxpayer bailout.

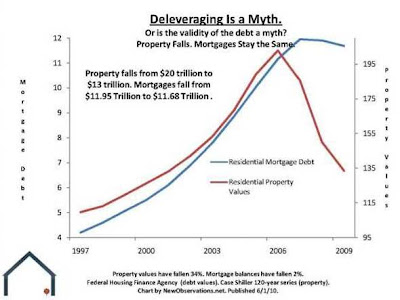

How can the housing market possibly be "stabilizing" and inventories be "returning to a healthy level" given all of this evidence to the contrary? The housing market is one giant black hole of wasted resources and fraudulent representation of the numbers. What's worse is that via the FHA, the Government has been using taxpayer money to subsidize a significant portion of the mortgages that have been used to purchase homes since 2008. And now it's the FHA's turn to blow up.

It will be impossible for the housing market to ever bottom and stabilize until this country recovers economically. This means real jobs are created which create real income growth and real employment growth. Furthermore, the totality of the existing REAL inventory has to clear the market. This requires demographic growth that our system can not possibly support until all the problems we know about are solved and put behind us. THAT, my friends, will never happen in my lifetime or your's.