As to be expected, the mass financial media and most real estate market professionals (and of course a lot folks who have been well-trained by the Fed to "buy the dip" over the last 30 years) expect that the worst is over for the sector. Au contraire, mon frére (I guess I should say "al contrario, il mio amico - lol), there are several key forces at play, most of which go underreported, not reported, or are based on industry/Govt data which is highly manipulated.

Inventory - The biggest problem facing the housing market is the massive inventory sitting out there. Of course, the Nat'l Assoc. of Realtors reports the inventory of homes for sale to be around 3.7 million, or 9.5 month supply based on the existing rate of sales. Remember that rate of homes sales is still declining - existing home sales were down 28% for Nov '10 vs. '09 and new home sales were down 21% - so as we go forward, unless this rate picks up, the number of months it would take to clear the existing "for sale" inventory increases.

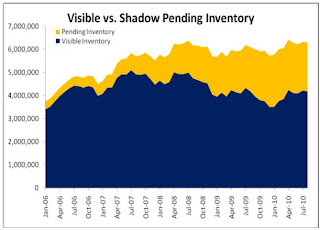

But there is a "shadow" inventory out there defined as pending REO (bank owned), pending foreclosed inventory and homes with mortgages in serious delinquency. Corelogic has defined this number to be around 2 million homes. Here's a great chart I borrowed from calculatedriskblog.com:

(click on chart to enlarge)

As you can see, if you include the homes that are likely to be foreclosed and assumed by the banks, a more realistic estimate of the housing inventor is close to 6 million. And there are also a lot of people who are not in danger of defaulting on their mortgage, but who would sell if the market "bounces." If you are skeptical of the forces of foreclosure, here's a news report from Reuters that came out last week describing the big jump in foreclosures during Q3: LINK

So just based on the pure, good old fashioned law of supply/demand, there is going to have to be a major downward adjustment in the price of housing in order to clear this massive inventory overhanging the market.

Credit Markets - The biggest factor here is interest rates. For several reasons, not the least of which is the rapidly expanding Government spending deficit and Treasury bond supply, interest rates will continue moving higher during 2011. This factor alone, unless you have cash to buy a house, will make the current price level of housing unsustainable as the higher cost of a mortgage will reduce the overall amount someone can pay for a home by reducing the size of an affordable mortgage. This is going to hammer the mid-priced housing segment.

The other obvious factor here is the much tighter standards being enforced on mortgage lenders. No more "liar" loans, pay-option ARMS and "sub-primers" qualifying for conventional GSE mortgages. This factor not only eliminates a chunk of the population that had been buying homes during the bubble, but it too reduces that size of mortgage most people can assume.

And finally, there is another tsunami of adjustable rate mortgage resets and refi's coming in 2011. Here's a chart to illustrate that is from Credit Suisse (edit in red is mine):

(click on chart to enlarge)

As you can see, the housing market price collapse that started in 2007 is highly correlated with the first wave of resets. It took a few trillion of printed dollars from the Fed and the Treasury in order to stabilize the banking system and slow down the collapse in housing from this first wave. Take a look at the size and composition of the second wave. The beige bars are the nefarious pay-option ARMS, which were designed to let people opt not to pay most of their mortgage, with the unpaid portion added to outstanding mortgage balance. It was this garbage that took down Countrywide, Washington Mutual and Wachovia. The credit obligation from that abortion was largely transferred to the Treasury (i.e. the taxpayer). Rest assured, the pay-option reset factor alone will make this next default wave even more nuclear than the last one. (Also, I am skipping over all of the related collateral destruction the first time around, which includes the implosion of the big mortgage reinsurance companies, including AIG - who's garbage found a home with the U.S. Treasury). This will devastate housing/real estate values.

There are several other factors which will further influence the declining value of housing and real estate. The most prevalent being the general weak condition of the economy in the U.S. And I am of the view that the economy will double dip this year (although massive QE/money printing may prevent this). The reality is that the two major factors discussed above will be sufficient to cause what I believe will be a much larger than expected (by the media/Wall Street in general) decline in housing values during 2011. I would not be surprised to see at least 10% in most markets. While I have stopped putting a definitive timeframe on my economic/market predictions, I still believe that average prices in the housing market will get cut in half from here before this over.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

Because I have a trading hat on I think homebuilders will be hot in mid year due to a new housing buyers credit (=instant loss). The panic over this will lead to even more free cash (like there is not enough?) and thus higher metal prices.

ReplyDeleteI don't think renewing the homebuyer tax credit is on the table this year. I just don't see how new home sales will be anything but horrible.

ReplyDeleteHey, email me with your email address - i posted on your comment section last night that I lost your email.

Shadow Inventory?

ReplyDeleteJust ask Dr. HB about it...

Welcome to the United States of Foreclosures – California lists 99,000 foreclosures for sale on the MLS but 372,000 homes are active in the foreclosure process

Just curious Dave: When do you think the bottom may be reached...when the rest of the world starts buying our real estate? Grazie mille.

ReplyDeleteWhen the Chinese start taking over our country

ReplyDeleteThe Chinese have already started taking over the United States. Where you been?

ReplyDeleteWhile I’m not going to say you’re wrong on the option-arms, I think that chart is from 2007 and since then obviously a lot has happened. I would guess that a bunch of those are already part of the default/foreclosure slush

ReplyDelete