Second, the Government released its "income statement" for the month of October, the first month of the Govt's Fiscal Year 2013. It showed a $120 billion deficit, substantially higher than was expected and estimated and higher than October 2012's $98.5 billion. Here's the LINK The Government is saying "technicalities" led to a higher deficit. But the OMB didn't seem to know about those technicalities when it projected a $113 billion deficit a couple of weeks ago. Where were these seasonal "technicalities" last year? I smell an accelerating spending deficit coming, which means more printing!

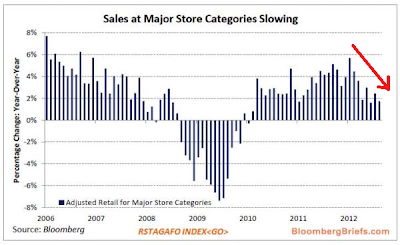

Also, retail sales for October were reported this morning and, not only did the headline number "miss" expectations, but the monthly print was negative - a sequential decline from September. The Obvious "explanation" for this is Hurricane Sandy. But the Government statistical geniuses typically make adjustments to smooth irregularities like that out of the number AND one would have expected to see a pop in retails sales, as areas expecting to be affected would have experienced a "run" on groceries, hardware items and propane. That excuse does not fit. Nevertheless, below is a chart sourced from Zerohedge, with the data sourced from Bloomberg, which shows monthly retail sales:

(click on chart to enlarge)

Anyone notice anything interesting (the red arrow is my edit)? Not only is the trend for retail sales declining pretty quickly, but it was also declining during the "all-important" back to school season, July - Sept. I think this chart encapsulates the picture of the average American's finances and lack of disposable income. The holiday season spending this year could be exceedingly ugly. It will be interesting to see if the banks roll out some incredible revolving credit deals for the season. If you do see that know that the Federal Reserve is behind that and, ultimately, the Treasury/Government.

Finally, I know I've been threatening to post a big report on the housing market, showing its impending demise. I have been collecting data for this and it will take some time to write something meaningful. Since I don't get paid to write this blog, I need to find the time - I'm hoping some time in the next week. What I can say is that, based on looking at the data I've compiled already, the "under the hood" data for the housing market is startlingly weak. I say "startlingly" because the Fed has driven mortgage rates to record lows, the banking industry in conjunction with the Government has prevented a lot of the "shadow inventory" from hitting the market and the Government has rolled out, thru FHA, a massive mortgage purchase and refinance program which is a "sub prime" quality lending program designed to try and really stimulate "organic"/primary residence purchases. All of those measures combined have barely stimulated a "bounce" in the numbers and the market is getting ready to do another big cliff-dive. To be continued...

With respect the Government's spending and debt accumulation situation, I fully anticipate that some way, somehow, after a lot of political grandstanding and accounting chicanery, an agreement to kick the fiscal deficit can down the road will be reached. We already know that the Democrats in the Senate, via Harry Reid's comment last week posted above on the right side of this blog, plan on asking for a $2.4 trillion bump in the Treasury debt limit ceiling. That tells you right there we can expect a deficit of at least $2 trillion for FY 2013. My personal view is that the politicians in DC do not have the mettle required to let the "fiscal cliff" event occur - neither does the President, nor would Romney have either for that matter. As history has shown time and again, the Government will spend and print until the currency ultimately collapses...

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

with the under 35 age group having serious problems getting any job (growth was skewed to the older part time workers) just who would be buying homes -starter homes , so everybody else moves up.

ReplyDeleteHouston we have a problem.

How About a Fort Knox of Your Own?

ReplyDeleteBy Paul Sullivan

The New York Times

Wednesday, November 14, 2012

Mining stocks were not for him, and neither was buying gold on the futures exchange. That was financial gold, meaning it existed on account statements but was not tangible. He wanted the real thing, gold in the form of bullion that he could hold in his palms, smudge with his thumbs.

But Mr. Tapiero, a portfolio manager at several hedge funds over the last two decades, realized quite quickly that it was harder to fulfill his desire than he had thought. When he called up one bank he patronized in his day job, he learned it had a minimum purchase amount of $20 million worth of physical gold. Even at that amount, he could not have access to it; it would have to stay at the bank.

He didn’t want to buy that much, but he wanted to buy more than a bag of gold coins, or a bar or two. Most of all, he wanted to know that it would be stored someplace safe where he could get to it even if all of the banks suddenly closed for a while. “There was concern at that time that the system was frozen and you didn’t really know whether you were going to be able to have access to your money or to your assets,” Mr. Tapiero said. “And I started thinking, O.K., well, I’d like to own something that isn’t a number on a flashing screen.”

http://www.nytimes.com/2012/11/14/your-money/some-gold-investors-want-their-own-fort-knox.html?pagewanted=all

maybe everyone should start asking what their pm does with their $?

ReplyDeleteNearly 50 million Americans in poverty under alternate measure

NEW YORK (CNNMoney) -- There were nearly 50 million Americans living in poverty in 2011, under an alternative measure released by the Census Bureau Wednesday.

That's 16.1% of the nation, higher than the official poverty rate of 15%. The official rate, released in September, showed 46.6 million people living in poverty.

Neither the supplemental nor the official poverty rates last year were significantly different than in 2010.

The Census Bureau's second annual supplemental poverty measure includes various government benefits and expenses not captured by the official poverty rate, which will continue to be used to determine eligibility for public assistance and federal funding distribution. The alternative calculation also takes into account geographic differences in prices.

Work, medical and federal tax expenses drove more people into poverty, the report showed. These costs outweighed the benefit of non-cash public assistance, such as food stamps, housing assistance and refundable tax credits, which lifted many Americans out of poverty.

Keeping people out of poverty

The alternative measure showed the importance of Social Security and the weight of medical care on the elderly. Without Social Security, some 54.1% of Americans age 65-plus would be in poverty, as opposed to 15.1%. But if they didn't have to pay out-of-pocket health care costs, their poverty rate would have fallen nearly in half to 8%.

http://money.cnn.com/2012/11/14/news/economy/poverty-americans/index.html?iid=HP_LN

InVeRTeD MaRXiSM In AMeRiKa...

ReplyDeleteThis chart makes it perfectly clear

How Klepto-Marxism is here

Both Parties make good

A reverse Robin Hood

So peasants get poked in the rear

The Limerick King

Bernanke is nothing like Che

The People he seeks to betray

Ben's revolution

Is fiat dilution

It's Banksters that Ben likes to pay

The Limerick King

Such is the plight of the poor

The Kleptocrats always want more

A system of greed

Has now been decreed

A system that may lead to war

The Limeric King

http://www.zerohedge.com/contributed/2012-11-14/inverted-marxism-amerika

Not half as ugly as it is getting at AUMN and the rest of the gold and silver shares.

ReplyDeleteF.H.A. Audit Said to Show Low Reserves

DeleteThe Federal Housing Administration’s annual report is expected to show a sharp deterioration in the agency’s financial condition, including a shortfall in reserves, the result of escalating losses on the $1.1 trillion in mortgages that it insures, according to people with knowledge of the entity’s operations.

The F.H.A., the Department of Housing and Urban Development unit that insures home mortgages, reports on its capital reserves at the end of each fiscal year and makes projections for its financial position in the coming year. If the report, due later this week, showed that the F.H.A.’s capital reserves had fallen deep into negative territory, it would be a stark reversal from projections last year that it would show a positive economic value of $9.4 billion in 2012.

http://www.nytimes.com/2012/11/15/business/fha-expected-to-report-declining-finances.html

Barrick not mining that is good for PM prices, wipes out potential supply.

ReplyDeleteFERC Suspends JPMorgan Unit’s Power-Trading Authority

ReplyDelete“The provision of false, misleading or inaccurate information undermines the integrity of the FERC decision-making process, the smooth operation of markets and FERC’s ability to ensure just and reasonable rates for customers,” FERC said in an e-mailed statement. “The commission continuously has warned market participants of the consequences associated with failing to abide by FERC rules and regulations.”

Regulatory Trouble

While the unit accounted for a small portion of JPMorgan’s $97.2 billion in 2011 revenue, yesterday’s decision adds to regulatory trouble for the New York-based company. At least 10 federal agencies and a U.S. Senate panel are investigating a multibillion-dollar trading loss at its chief investment office in London.

FERC Proceeding

The FERC said in September it had initiated a proceeding against the energy trading unit. The case focuses on whether JPMorgan’s energy division, a part of the company’s commodities unit run by Blythe Masters, met its obligations to provide documents to Caiso.

J.P. Morgan Ventures Energy allegedly made bids that resulted in at least $73 million in improper payments to the generators, according to the FERC. The investigation came to light when the commission went to court seeking internal e-mails from JPMorgan.

http://www.bloomberg.com/news/2012-11-15/ferc-suspends-jpmorgan-unit-s-power-trading-authority.html

Oh...London's calling....

Negative Nominal Interest Rates?

ReplyDeleteMoney has historically had multiple functions; a medium of exchange, a unit of account, a store of purchasing power. To institute a zero interest rate policy is to disable money’s role as a store of purchasing power. But to institute a negative interest rate policy is to reverse money’s role as a store of purchasing power, and turn money into a drain on purchasing power.

Money evolved organically to possess all three of these characteristics, because all three characteristics have been economically important and useful. For central bankers or economists to try to strip currency of one of its essential functions is to risk the rejection of that currency.

How would I react in the case of negative nominal interest rates? I’d convert into a liquid medium that was not subject to a negative rate of interest. That could be a nonmonetary asset, a foreign currency, a digital currency or a precious metal.

In Kimball’s theory, this unwillingness to hold currency is supposed to stimulate the economy by encouraging productive economic activity and investment. But is that necessarily true? No — it will just drive people away from using the currency as a store of purchasing power. So long as there are alternative stores of purchasing power, there is no guarantee that this policy would result in a higher rate of economic activity. Indeed, its side-effects may drive economic activity much lower.

But it will drive economic activity underground. While governments may relish the prospect of higher tax revenues (due to more economic activity becoming electronic, and therefore trackable and traceable), in the present depressionary environment recorded and taxable economic activity could even fall as more economic activity goes underground to avoid negative rates. Increasingly authoritarian measures might be taken — probably at great cost — to encourage citizens into using the negative-yielding legal tender.

Banking would be turned upside down.

http://azizonomics.com/2012/11/15/negative-nominal-interest-rates/

Tango with the Tax Man

ReplyDeleteLarge multinationals, many of them based in the United States, are masters at avoiding taxes on profits made abroad. Apple, for example, paid just $100 million in taxes in 2010 on overseas profits of $13 billion. But Germany would like to put a stop to the practice, and is finding some influential support. By SPIEGEL Staff

The new designation will allow E.on to move its headquarters abroad, making it easier for the company to circumvent national and international fiscal authorities. In the jargon of tax experts, E.on is providing itself with new "options for fiscal optimization." It's completely legal, but it comes at the expense of the treasury.

The switch to SE will also allow the corporation, intentionally or unintentionally, the opportunity to catch up in a discipline where German competitors have lagged behind an elite league of multinational corporations: that of raking in billions while paying almost no taxes at all.

Corporations like Pepsi, Starbucks and Intel sell their products around the world, and seek to establish reputations for being environmentally conscious, progressive and socially responsible. But when it comes to allowing the government to collect a suitable portion of their corporate profits, the icons of global capitalism prove to be antisocial in the extreme.

How to Look Poor

According to data compiled by independent tax experts, US technology giant Apple paid a paltry $130 million (€102 million) in taxes on foreign earnings of about $13 billion in 2010. Microsoft paid only $1.7 billion on $15 billion in foreign earnings, while software giant Cisco paid a tax bill of $400 million on foreign earnings of more than $8 billion.

The operations corporations launch to optimize their tax bill go by various names, including "Double Irish" and "Dutch Sandwich," but the principle is always the same. In a confusing network of parent companies and subsidiaries, foreign branches and holding companies, sales, earnings and costs are shifted back and forth so many times that the companies end up looking poor wherever tax rates are high. The remaining earnings are generated primarily in low-tax countries.

Years ago, the Organization for Economic Cooperation and Development (OECD) estimated that 60 percent of all international trade happens within multi-national corporations. Following the letter of the law, they do business with themselves, taking advantage of tax laws in different countries to minimize their burdens.

http://www.spiegel.de/international/business/effort-to-close-multinationaltax-loopholes-gaining-steam-a-866989.html

This should hit close to home Dave as Johns Manville is a Denver based company

ReplyDeleteBerkshire replaces Raba as Buffet sees housing rebound. Rhinehart will oversee a unit with about 7,000 employees and 45 manufacturing facilities in North America, Europe and China. Johns Manville makes insulation and roofing and has customers in the aerospace, automotive and building industries. The new CEO has been with the company more than 30 years

Better get that housing report of yours completed

http://www.bloomberg.com/news/2012-11-13/berkshire-s-manville-says-ceo-raba-departs-rhinehart-promoted.html

LOL. You wanna know what's funny? The biggest debt collection agency in Colorado is headquartered in the old Manville building on 17th St. downtown.

DeleteBuffet has a very poor track record with the housing materials business. I remember clearly back in like 2001 when he took over USG (U.S. Gypsum was one of the biggest wall board producers)right before it went bankrupt. He paid something like $18/sh and it went tits up 6 months later...

Buffet is far from infallible and in the last 10 years he's made a lot of big mistakes. Just look at the 10yr track record of BK/B vs. the SPX

...and how many mistakes would he have had without the bailouts.

DeleteOpen Letter to Hugo Salinas Price

ReplyDeleteDear Mr. Price:

I read your piece: “On the Use of Gold Coins as Money”. I think you ask the right question. This is the elephant in the room. Why do gold and silver not circulate?

I love your analogy of the Swiss asserting that they will “allow” gold to have a monetary role, this being like “re-hydrating water.” It is not within the power of foolish governments either to imbue water with wetness, or gold with moneyness.

Gold is already money. It is the commodity with the tightest bid-ask spread. It is the commodity with the highest ratio of inventories divided by annual mine production (stocks to flows). And it is the commodity whose marginal utility does not decline. These statements are as true for gold today as they were under the gold standard 100 years ago.

Let’s look at marginal utility. I think you hit the nail on the head: people will pay in anything but gold, if it is possible to do so. People prefer to keep gold, and this preference has nothing to do with the amount of gold they or anyone has.

There is one thing that will motivate people to place their gold at risk, and give up possession (temporarily).

Interest – paid in gold.

Interest can lure the gold and silver out of hoards and to the twin tasks at hand: recapitalizing the financial system and financing production. Then it is just a matter of time. First bondholders and then suppliers are paid in gold. Gold begins to circulate.

http://www.acting-man.com/?p=20518

How Shadow Banks Rule the World

ReplyDeleteBeyond the banking world, a parallel universe of shadow banks has grown in the form of hedge funds and money market funds. They're outside the reach of conventional financial regulation, prompting authorities to plan introducing new rules to prevent the obscure sector from triggering a new financial crisis. But in doing so they risk drying up an important source of funding to banks and firms.

In the financial world, there is a narrow divide between heaven and hell. Frenchman Loïc Féry realized this when he was 33. He was a rising star in the banking world, managing the trade in complex loan packages for an investment bank. According to his business card, he was the bank's "global head of credit markets." But then one of his employees gambled away about €250 million ($317 million), and suddenly Féry was without a job.

That was in 2007. A number of investment bankers experienced a similarly precipitous fall in the turbulent years of the financial crisis. But, like Féry, many reappeared before long and became more successful than ever, in the world of the so-called shadow banks. These are companies that engage in business similar to that of ordinary banks, but without being subject to the same strict regulation.

Féry launched a hedge fund in London. These notorious investment firms collect money from customers and speculate with a wide range of securities. Today Féry makes the kinds of investments that are too risky for his former colleagues. He lends the money of his customers to companies whose creditworthiness isn't good enough to qualify for loans from ordinary banks, and he also buys especially risky loan packages from lenders. As a result, he is able to achieve double-digit returns in the midst of a crisis.

But the Frenchman, who has become so successful that he was able to buy a first-division football club, FC Lorient, insists that companies like his make "a positive contribution to the real economy," because they manage risks professionally.

Growing Concern About Lack of Regulation

But banks, regulators, politicians and economists are worried about the parallel universe that has developed beyond the major banks. Until the 2007 financial crisis, shadow banks grew at a pace similar to that of ordinary financial institutions. Hedge funds, special-purpose entities and money market funds benefited from the low interest rates offered by central banks. Banks increasingly used outside companies to handle all the deals that were too risky for them, so that they wouldn't appear on their books. In this manner, shadow banks and regular banks collaborated to build a castle in the air made up of loans.

Within a few years, the volume of financial transactions in the world of shadow banks grew from $27 trillion to $60 trillion today. Now regulators finally want to clamp down and set up a regulatory framework that has so far been conspicuous by its absence for this sector.

http://www.spiegel.de/international/business/concern-over-lack-of-regulation-of-shadow-financial-institutions-a-866763.html

It’s Called “Grand” Bargain For Good Reason

ReplyDeletePosted on November 15, 2012 by tradewithdave| Leave a comment

You get one GRAND per month (approximately $1,100) to retire on with your Social Security benefit. Only one question remains. What’s left over for the cat in this Fancy Feast? PETA will never stand for such treatment of household pets. There ought to be a law. Cats have rights too you know.

On herding cats – it’s no wonder the cats have been so much more difficult to herd over the cliff than the sheep. In the Homer Simpson Bowles empty bowl plan the government pits pensioners against cats on competition for their food supply. Cats unite! Don’t fall for the cliff. It’s a trap.

http://tradewithdave.com/?p=13369

Dave’s got a sneaking suspicion that there’s a connection between the Geithner plan to break the buck on money market funds and the privatization of Social Security.

If Erskine can manage to keep a president from being impeached for proclaiming just what ”I did not have” with that woman, then who better to address millions of retiring baby boomer’s proclamation of just exactly what they did have invested with Lady Liberty in their social security accounts pre-vaporization. It’s not Mr. Bowles fault that his bowling partner is on the official JP Morgan bowling team as a member of the board of directors. If Erskine actually makes SecTreas post Geithner, then someone who is probably a genuinely good guy will end up like the Lee Majors equivalent of the Unknown Stuntman in the 1980′s TV series The Fall Guy. Erskine explains Magic Moments as sung by The Drifters to the same CNN journalist who explained to the world just how much we made on those bailouts.

http://maxkeiser.com/2012/11/15/its-called-grand-bargain-for-good-reason/

@ Anonymous - Acting-man

ReplyDeleteI really liked your Open Letter to Hugo Salinas-Price.

The only exception I would take to it would be to point out that it is silver that has by far the largest stock to flow ratio. (See http://screwtapefiles.blogspot.com.au/2012/08/so-how-much-silver-is-really-out-there.html,

and the folow-up: //screwtapefiles.blogspot.com.au/2012/10/what-and-where-was-all-that-silver.html)

I would add that gold has an additional attribute that makes it the best form of money ever discovered: It has no really essential or worthwhile economic uses, so withholding it from the market (hoarding it) as a means of preserving purchasing power does not detract from general economic activity or productive enterprise.