The run-up in the stock market (the SPX for purposes of this article) has been nothing short of stunning. Since hitting a sell-off bottom on October 4, 2011, the SPX has run-up a nearly non-stop 47.8%. In just the last month, the SPX has run up 7.5%. This is in the face of deteriorating economic indicators and declining corporate revenues. The stock market has for sure taken most observers and professionals by surprise, except for maybe the most passionate "perma-bulls."

Given this incredible move higher in stocks, I wanted to investigate a couple of possibilities for what is fueling this near-parabolic stock rally. Based on what I've been able to come up with, it's pretty clear that stocks are rocketing higher on Fed fuel and not fundamentals. But don't take it from me, it seems that some high profile billionaire investors are unloading their big positions, especially anything related to consumption: Billionaires Are Dumping Stocks. Let's take a look "under the hood" of the economic and financial system and see if we can figure out why.

While Bernanke was giving his report on the economy and monetary policy to the Joint Economic Committee of Congress today, in which he pretty much laid to rest any fears that the Fed would "taper" its monetary policy and bond purchase program anytime soon, I decided to look into some of the Fed's monetary data as reported on the St. Louis Fed website. Specifically I wanted to look at the Adjusted Monetary Base, which is the sum of the currency in circulation plus the commercial bank reserves held at the Fed, because this monetary account is the one directly affected by the QE program.

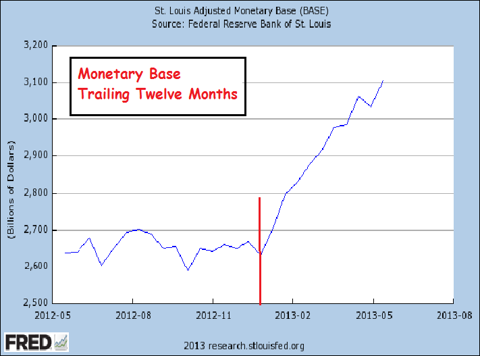

Here's the most current snap-shot of the Monetary Base going to back to 1984, when the data-series began:

(click to enlarge)

Close to $2.8 trillion in money has been printed and used to purchase assets from the banking system, ranging from highly distressed toxic waste to short-term Treasury notes.

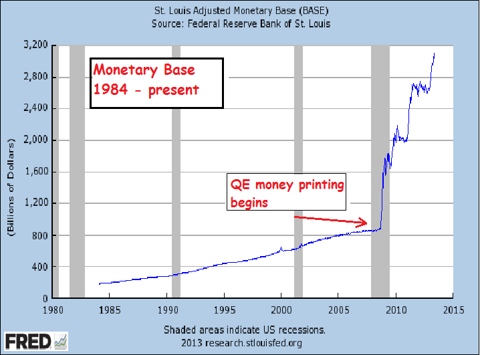

Next I decided to "blow up" the chart above and look at just the last twelve months and compare it to the same time period for a chart of the S&P 500:

(click to enlarge)

(click to enlarge)

As you can see, there is nearly a 1:1 correlation between the near-parabolic growth in the Monetary Base since the end of November 2012 and the near-parabolic trajectory of the SPX since mid-November (marked by the vertical red lines). I don't have time to run the data, but my University of Chicago B-School training visually tells me that the correlation is probably around .8, if not higher, meaning 80% of the move in stocks since November can be attributed to the increase in the Fed's Monetary Base.

Without doing a data dump of recent corporate earnings reports, we know that regardless of the net income being reported (net income being potentially subjected to many forms of GAAP accounting manipulations), that the revenues being reported by the largest of the SPX companies are flat to down. This is not the sign of an economy that is capable of growth and true earnings expansion. To give one example, Caterpillar (CAT) recently reported its April revenues. Globally sales were down 9% from March, but they were down a shocking 18% in North America: CAT April revenues. This is primarily heavy machinery related to construction and homebuilding. If CAT's sales are plunging like this, it means that construction and homebuilding are likely getting ready to drop pretty hard.

My point here is that economic and corporate fundamentals are not supporting the rapid move higher in the stock market and the concomitant rapid expansion in the market values of individual companies. To reinforce this point, I wanted to show a chart that I sourced from Zerohedge, which maps out the accelerating decline in the per share operating income of the S&P 500 over the last 12 months:

(click to enlarge)

In other words, based on economic and corporate earnings reports which are suggestive of a slow down in the economy, combined with the fact that corporate operating income is plunging, there can be no doubt that the run-up in the stock market is unequivocally not supported by fundamental factors.

That leaves only the money being printed by the Fed. Wall Street analysts can crow all they want about how the economy is improving and corporate earnings will improve, but the proof so far is in the numbers, which show that just the opposite is occurring.

Moreover, Fed officials can talk all they want about tapering QE, but if you look at their actions based on the recent move in the trailing twelve month Monetary Base above, not only are they not tapering, they are actually increasing the rate at which they are injecting liquidity into the banking system. In my mind, at least, there can be no doubt that the money being printed by the Fed is what is fueling the stock market.

Now we can debate whether or not the Fed is serious about "tapering" its printing. But I have no doubt based on the evidence I presented today that if the Fed were indeed to "taper," the stock market suffer a serious and rapid decline.

The real question now is for how long can this stock market "melt up" last? No one can possibly know that answer for certain, but at this point buying stocks right now is not about analyzing fundamentals and value, but more akin to playing stock market roulette. Anyone who has been fortunate enough to take advantage of being long the stock market should seriously consider hedging or taking a significant portion of their investment off the table.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

Seems that there is a bleed off of cash from the markets that is being redeployed into other assets.Real estate is rising in select markets,L.A.,Miami,New York, Chicago. It will be another bubble and because of a weaker economy then 2008 this bubble should be epic.

ReplyDeleteI don't want to be an alarmist Dave, but I have reviewed no less than 7 charts in the past week which indicate divergences from another universe.

ReplyDeleteNOTHING co-relates to reality.

You give the central bankers a chance to test their power and they "alter reality" as proof of absolute power.

And we all know what absolute power does.

Hold onto your rip cord, the turbulence is going to be breathtaking ....

Great post, Dave. Any cui bono questions about the Fed's QE programs can be answered by comparing this pair of St. Louis series:

ReplyDeletehttp://research.stlouisfed.org/fred2/series/N3291C0A144NBEA?cid=33033 (finance)

http://research.stlouisfed.org/fred2/series/N3211C0A144NBEA?cid=33033 (construction)

What is puzzling about these graphs is the inflection point in each that appears in about 2Q09. Isn't that when mark-to-fantasy accounting was sanctioned by Congress, around the same time the market bottomed after the '08 crash (2 days after Obama noted record law "profits and earnings" ratios)? You'd think that would've helped the finance sector more than construction. Alas...

Dave, the Fed funds market is telling me reserve provision may have accelerated also. One never knows all the technicals but the funds rate has been trading nearer to zero the last week or so. When you ask for opinions people concentrate on the action of different players but I think the bottom line is even more reserves are sloshing around in the short end.

ReplyDeleteI would add that the job market is changing things too. Full time to part time and a cut in benefits. maybe even pay rate since there is supply of workers. So companies are getting cost savings that sooner or later will end.

ReplyDeleteThey are hiring more people for sales as they don't have to pay you as salary, only 5% commission. HP did this in 2009 as they laid off thousands and hired the same amount back in 2010 except as sales people. Piece-meal jobs are popping up as well as P/T 8.25 a hour using your own vehicle with no reimbursement for gas. Welcome to the "New Normal".

Deletemere pikers!

ReplyDeleteChris Martenson has an article out, same theme, but he shows $NIKK Nikkei, up 70% in 6 months, as yen has fallen 30%.

Who says Birinyi can't be right in mere months?

"The former outcome is that envisioned by the theoreticians that lead the Fed: According to this plot, by driving rates to historical lows along the entire length of the yield curve, investors will rebalance their portfolios and reach out to riskier assets, providing the financial wherewithal for businesses to increase capital expenditures and reengage workers, expand payrolls and regenerate consumption. Rising prices of bonds, stocks and other financial instruments will bolster consumer confidence. The CliffsNotes account of this play has the widely heralded “wealth effect” paving the way for economic expansion, thus saving the day.

ReplyDeleteThe latter outcome posits that the wealth effect is limited, for two possible reasons. One is that our continued purchases of Treasuries are having decreasing effects on private borrowing costs, given how low long-term Treasury rates already are. Another is that the uncertainty resulting from fiscal tomfoolery is a serious obstacle to restoring full employment. Until job creators are properly incentivized by fiscal and regulatory policy to harness the cheap and abundant money we at the Fed have engineered, these funds will predominantly benefit those with the means to speculate, tilling the fields of finance for returns that are enabled by historically low rates but do not readily result in job expansion. Cheap capital inures to the benefit of the Warren Buffetts, who can discount lower hurdle rates to achieve their investors’ expectations, accumulating holdings without necessarily expanding employment or the wealth of the overall economy." - Dallas Federal Reserve President Richard Fisher.

http://www.dallasfed.org/news/speeches/fisher/2013/fs130516.cfm

U.S. Merchant Marine, American workers, farmers, and the hungry of the world shafted in Obama Administration budget Cash replaces Food for Peace eliminating U.S.-flag carriage of commodities overseas.

ReplyDeleteRather than sending food overseas to the hungry, grown by American farmers, loaded by American longshore workers and carried in U.S.-flag vessels with American merchant mariners, the President seeks to “reform” food aid by eliminating the food and sending cash instead so food can be bought locally.

Food for Peace, as it has been structured since 1954, would cease to exist. The funds would be transferred out of the Department of Agriculture budget to the State Department.

http://www.sailors.org/pdf/newsletter/wcs-apr2013.pdf

Dave,

ReplyDeletewe used to have to wait sometimes a few days in between blogs but lately you've been cranking out at least one a day! OTOH there has been quite a bit of fodder out there lately. Keep up the good work.

Ken

Thanks for the feedback. The frequency of my posts is directly correlated to my level of irritation with degree and amount of all the bullshit being thrown at us.

DeleteFuel....

ReplyDeleteEU Weighs Curbs on Banks’ Use of Client Assets as Collateral

Banks and brokers face a clampdown on using assets they hold for clients as collateral for their own trades as part of European Union moves to bolster market stability and rein in shadow banking.

The European Commission is weighing whether firms should have to obtain formal consent from their clients before being allowed to reuse assets to back other trades, according to a document obtained by Bloomberg News. The consent would be enshrined in a “contractual agreement” between the parties.

The handing over of collateral is an integral part of repurchase agreements, or repos -- one of the activities under review by global regulators as part of their efforts to regulate shadow banking. The reuse of clients’ assets poses a potential threat to financial stability should one of a chain of firms that handled the securities go bankrupt, according to the document prepared by commission officials and dated May 15. Uncertainty about who holds an asset can fuel panic in times of market stress, according to the paper.

“Complex” chains of collateral can make it difficult for investors to “identify who owns what, where risk is concentrated and who is exposed to whom,” according to the document. “This has consequences for transparency and financial stability.”

http://www.bloomberg.com/news/2013-05-24/eu-weighs-curbs-on-banks-use-of-client-assets-as-collateral.html

I am not an expert on all of the ways that wallstreet or for that matter any other locations throughout the world that make their livings creating ways to make money from paper or cyber transactions all based on a thing or concept.

ReplyDeleteBut I do know one thing. A concept. A belief. An inside trade. An investment on a tip. A ride on a wave of other investors all in , will only continue to move in an upward direction based upon a strong economy... and this economy is not that.

If you don't own physical gold and silver you might want to rethink that one , and soon.

And for all who do, hang on tight. The wild barrel spins are ahead. Don't let go.

Dave, I have a question. What's the purpose of JPM maintaining such a large concentrated short position in the silver market? If JPM is short on gold, it is defending the USD for the Fed. But why short silver? Not many people pay attention to silver.

ReplyDeleteJPM is even more pro-active and manipulative of the silver market. The coming short squeeze in silver will be bigger than the one in gold

DeleteHey Dave, Don't know if you got a chance to see this, Grant Williams does the math. Looks like the friggin world is in for one hell of a ride. I guess you could call it our 100 year storm. I think I'm gonna need a bigger board.

ReplyDeletehttp://www.zerohedge.com/news/2013-05-26/grant-williams-do-math

“There is the world that’s manipulating gold and the world that is buying gold. And in the world that’s manipulating gold all we have to do is look at the beginning of the week when Fed Chairman Bernanke came out and talked about whether or not they were going to keep interest rates low, or (have) more quantitative easing, and (then) we saw the reaction on the Street (Wall Street).

ReplyDeleteFollowing that gold spiked and then of course pulled back a bit, but for no reason at all because as you are looking at the real market conditions, there is no (economic) recovery, period. What have they dumped in, Eric? Some $17 trillion since the panic of 2008 hit, between quantitative easing and pumping money into the system.

Look at the numbers coming out, the recovery is tepid at best and now you have a slowdown in China. You still have a slowdown in Europe. It’s only getting worse over there. Interest rates are at record lows and gold should be at record highs.

But it’s not in the interest of the central bankers around the world to have high gold prices because if gold prices were high, then people would realize that they don’t have any value in buying paper garbage. And that’s all this is. They (central planners) are driving down gold prices to keep their paper garbage at a salable price so that people still believe in the failing system.” - Gerald Celente spoke with King World News at length about what is taking place in gold and silver markets.

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/5/25_Celente_-_$17_Trillion_%26_The_Two_Worlds_of_Gold_%26_Silver.html

While Japan is getting all the press & hysteria, anyone keeping up on this trade, supposedly put on by the Swiss as their counter-trade (long) against shorting the Euro to drive it down against their franc when they pegged it back in Sept 2011 to the Euro?

ReplyDeleteI read they also went long the brit pound, which is looking pretty neutral to now.

But on the yen, somebody is out a ton or two of money, altho it is so overdone it's coming down:

http://stockcharts.com/c-sc/sc?s=$XSF:$XJY&p=W&yr=3&mn=0&dy=0&i=t58179189280&r=1369711510110

Dividend Deals So Hot Even Dr. Dre Seeking Loans: Credit Markets

ReplyDeletePrivate-equity firms from Bain Capital to Onex Corp. are raising loans through companies they own to pay themselves dividends at a pace that exceeds even the frothy days leading to the worst financial crisis since the Great Depression.

Borrowers controlled by buyout firms are on pace to raise more than $11.5 billion this month through dividend deals, a record and up from $3.6 billion in April, according to Standard & Poor’s Capital IQ Leveraged Commentary & Data. Beats Electronics LLC, the headphone maker founded by rapper Dr. Dre and Geffen A&M Chairman Jimmy Iovine, is meeting lenders tomorrow to seek $700 million in such loans, according to people familiar with the situation who declined to be identified.

http://www.bloomberg.com/news/2013-05-28/dividend-deals-so-hot-even-dr-dre-seeking-loans-credit-markets.html

out of control

‘Cov-lite’ loans soar in dash for yield

Investors are giving up many of the protections that have traditionally accompanied lending to risky companies, with the hunt for high-yielding assets shifting the balance of power towards borrowers.

Many of the world’s most highly indebted companies have been able to issue new loans without covenants, which limit the amount of debt they can take on or which give lenders a major say in the business if its results start to lag.

The proportion of so-called “cov-lite” loans has soared to more than 50 per cent of all leveraged loan issuance so far this year, twice the level seen during the credit boom in 2007. Leveraged loans are issued by high-risk companies, such as those owned by private equity firms, and sold to investors through the credit markets.

Some strategists argue that cov-lite lending could be a “new normal”, the wisdom of which will be tested in the next economic downturn. Moody’s, the credit rating agency, last week said it saw signs of a “covenant bubble” that poses dangers for loan investors when the US Federal Reserve begins to tighten monetary policy.

Covenants typically set parameters that force a company to stay within a particular debt-to-earnings ratio, or keep earnings above a certain multiple of interest payments. If covenants are breached, creditors can insist on a financial restructuring, even if the company is not close to bankruptcy.

“The cov-lite structure creates an opportunity for companies to take more financial and operational risks and transfers influence in a distressed credit from lenders to shareholders,” the rating agency wrote. “Investors may not be fully compensated for the risks they are taking on.”

So far this year, $129bn of leveraged loans have been sold with cov-lite features, up from $22bn in the same period last year, according to S&P Capital IQ data. Issuance was $96bn for the whole of 2007.

http://www.ft.com/intl/cms/s/0/36f17396-c4a2-11e2-bc94-00144feab7de.html#axzz2UbCWQhP3

Relentless good news in the housing market, and if the Fed keeps printing possibly relentless upward momentum in the stock market....maybe if you can't beat'em join'em? The PM trade could remain flatlined for a long time.

ReplyDeleteInvestors are giving up many of the protections that have traditionally accompanied lending to risky companies, with the hunt for high-yielding assets shifting the balance of power towards borrowers....how to invest in stocks

ReplyDeleteThe stock market has for sure taken most observers and professionals by surprise, except for maybe the most passionate "perma-bulls." Investing in Stocks

ReplyDelete